Algorithmic Trading: Build, Test & Automate in 2025

A practical 2025 guide to design, backtest, and automate algorithmic trading strategies that run reliably across markets.

What you’ll learn

- How algorithmic trading works end to end

- Common strategy types and when to use them

- Backtesting, validation, and risk controls

- How to automate ideas with Obside

Table of contents

- What is algorithmic trading?

- How algorithmic trading works

- Types of strategies

- Strategy development lifecycle

- Practical examples

- Data, indicators, and signals

- Execution quality, slippage, and fees

- Risk management

- Backtesting pitfalls

- Measuring performance

- Tools and platforms

- Actionable step-by-step

- Benefits and considerations

- Conclusion

- Frequently asked questions

- Related articles

What is algorithmic trading?

Algorithmic trading is the use of rules defined in code or structured logic to make trading decisions and place orders automatically. These rules can consider price, volume, indicators, events, or off-market data to decide when to buy, sell, scale in, or rebalance. The aim is to replace inconsistent discretionary decisions with a proven plan executed at speed and with discipline.

Modern platforms make this accessible. With Obside, you can describe rules in plain language, then convert them into alerts, automated orders, and portfolio management that runs in real time. If you want to compare platforms and approach, see our guide on the algorithmic trading platform landscape for structure and selection tips.

For background reading, see Wikipedia’s overview of algorithmic trading, and Investopedia definitions for indicators like RSI and MACD.

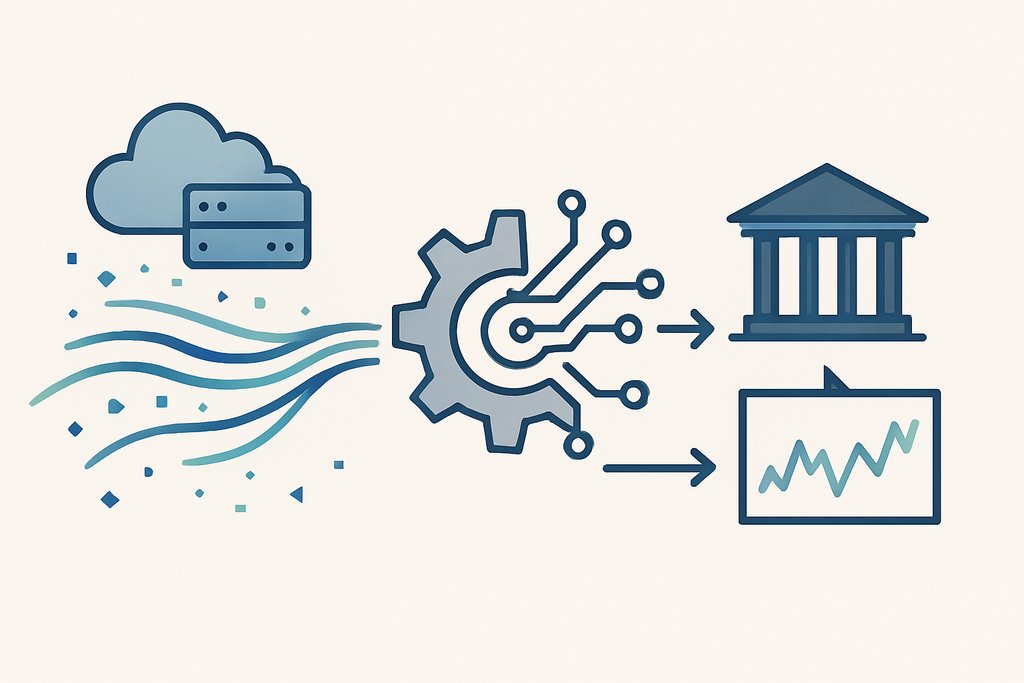

How algorithmic trading works: from idea to execution

At its core, algorithmic trading is a workflow. You collect data, form a hypothesis, turn it into rules, test and refine, then deploy with monitoring. The steps are consistent across assets and styles.

Data and preprocessing

Start with clean price and volume. Compute indicators from that base, then enrich with events such as earnings, macro releases, or specific headlines. High quality history supports backtests, while robust live feeds power execution.

Signals and logic

Signals indicate when to act. They can be simple, like a moving average crossover, or composite, combining trend, volatility, and sentiment. Your logic maps signals to actions such as buy, sell, reduce risk, or rebalance.

Execution and order management

Once a signal triggers, your system must place orders intelligently. Instant execution may be fine in liquid markets. Otherwise, use algorithms like VWAP or TWAP to reduce market impact, and handle partial fills and retries gracefully.

Risk and portfolio controls

Position sizing, stop losses, take profits, and exposure limits keep strategies resilient. Portfolio rules monitor correlation, leverage, and volatility to avoid concentration risk.

Backtesting and validation

Backtests simulate rules on history to estimate performance. Use realistic slippage and fees, test across regimes, and adopt techniques that reduce overfitting. If you are new to testing, read about paper trading and practice flows to bridge into live.

Monitoring and iteration

After deployment, track performance, errors, and changes in market conditions. Treat development as a continuous improvement loop. Obside lets you add alerts like “Notify me if daily volume doubles on Bitcoin” to monitor states.

Describe your rules, backtest in seconds, and connect your broker. Learn how in our guide to trading automation from idea to execution.

Types of algorithmic trading strategies

Algorithmic trading spans many approaches. You do not need high frequency infrastructure to benefit. Many profitable systems use hourly or daily bars and trade a few times per month.

Trend following

Trend followers ride persistent moves. A classic entry is a short moving average crossing above a long one, filtered by volatility. Trailing stops such as ATR based rules lock gains while letting winners run. In Obside you can specify multi timeframe logic like “When Supertrend is bullish on 2h and 8h, buy; exit on a flip with a 5 ATR trailing stop.”

Mean reversion

Mean reversion bets on snap backs after short term stretch. Tools like RSI, Bollinger Bands, or z scores define extremes. These work best in ranges, and they require firm risk limits since trends can persist.

Event driven and news based

Event driven trading reacts to catalysts such as earnings or macro releases. Combine rule based logic with data streams. For example, “Sell my stocks if new tariffs are announced,” or “Buy oil when a hurricane hits.” Obside lets you express such triggers in plain language and wire them to actions.

Statistical arbitrage and pairs trading

These methods exploit relationships among assets. Pairs trading may use cointegration, while broader stat arb uses factors and cross sectional signals. The math can be heavy, but execution still reduces to rules.

Execution algorithms

Not all algorithms predict direction. VWAP and TWAP split orders over time to minimize impact. Implementation shortfall aims to reduce slippage versus a benchmark. Even discretionary traders can standardize fills with these tools. For primers, see Investopedia on moving averages, RSI, MACD, and VWAP.

The strategy development lifecycle

Turn an idea into a robust strategy with a structured process. Whether you write code or use a no code platform, these steps keep you honest.

1) Ideation and hypothesis

Start with a testable idea and write why it should work, what structure it exploits, and what could break it.

2) Specification and data needs

Translate the idea into unambiguous rules, inputs, and timeframes. List the data you need, including any macro or news series, and define them upfront to avoid look ahead bias.

3) Backtesting

Run rules on history with realistic slippage, spreads, and fees. Use out of sample testing or walk forward analysis. Obside’s ultra fast backtesting helps you iterate quickly by simply adjusting your description.

4) Validation and risk checks

Evaluate risk adjusted metrics and stability across regimes. Look at Sharpe, Sortino, max drawdown, profit factor, and the equity curve shape. See Investopedia on the Sharpe ratio and Sortino ratio for definitions.

5) Paper trading

Paper trade before risking capital to confirm signal behavior and uncover operational issues. Our detailed primer on paper trading can guide your test plan.

6) Deployment and monitoring

Connect your broker or exchange, start small, and monitor fills, latency, and drift from backtests. Add alerts for state changes, such as a Supertrend flip or volume surges.

7) Review and iterate

All strategies decay eventually. Keep change logs, run periodic reviews, and treat updates as hypotheses with clear goals.

Practical examples: from simple rules to multi signal systems

Implementation creates the value. These examples match common goals and skill levels and can be expressed directly in Obside.

Example 1: Moving average crossover on equities

Use a 50 over 200 day crossover on a liquid ETF like SPY with a volatility filter and a 3 ATR trailing stop. Exit on a bearish cross or stop. Backtest 20 years, review drawdowns, and assess risk adjusted returns.

Example 2: RSI divergence on crypto intraday

On a 15 minute BTCUSD chart, buy when price makes a lower low but RSI makes a higher low, confirmed by a Supertrend flip. Stop at the day’s low, take profit at 10 percent, and skip entries if volatility is high.

Example 3: Event driven crypto buy on macro news

“Buy 1,000 dollars of Bitcoin if price is below 100,000 and the Federal Reserve announces a rate pause.” Combine with exposure cuts if daily volatility spikes. Obside can listen to verified feeds and act in real time.

Example 4: DCA with rules and guardrails

“Buy 50 dollars of Bitcoin every Monday at 10:00 AM, but skip a week if 7 day realized volatility exceeds 100 percent. If drawdown from the 90 day high exceeds 40 percent, increase buys to 75 dollars until a 20 percent recovery.”

Example 5: Portfolio allocation with dynamic rebalancing

Keep 50 percent in Bitcoin, 25 percent in Ethereum, and 25 percent in USDC. Rebalance weekly if deviation exceeds 5 percent. Scale down sizes when portfolio volatility rises above a target. You can browse and clone ideas in Obside’s strategy marketplace.

Data, indicators, and alternative signals

Price and volume are the foundation. Indicators like moving averages, RSI, MACD, Bollinger Bands, and ATR help structure decisions. For primers, see Investopedia on Bollinger Bands and ATR.

Alternative data expands opportunity. News, earnings calls, macro calendars, and even weather can become triggers. For crypto, on chain metrics and funding rates add context. Obside supports alerts like “Alert me if Bitcoin rises above 150,000 dollars and daily volume doubles,” or “Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish.”

Execution quality, slippage, and fees

Live results differ from backtests due to microstructure. Slippage is the gap between expected and filled price. Spreads and thin liquidity increase costs. Reduce impact with TWAP or VWAP, trade in liquid hours, and model costs in backtests. A robust platform helps by managing thresholds, retries, and time in force instructions. Obside centralizes broker connections so portfolio logic stays consistent across venues.

Risk management in algorithmic trading

Risk management is the backbone. Position sizing can be fixed fractional, volatility scaled, or based on Kelly style estimates. Use maximum loss per trade, daily loss limits, and overall drawdown stops. Align stops and targets with your edge, and constrain correlated bets at the portfolio level.

Automate de risking when regimes shift. For instance, “Reduce all positions by 50 percent if VIX rises above 35,” or “Close positions if the S&P 500 drops by 10 percent.” Obside lets you set global rules that overlay every strategy.

Backtesting pitfalls to avoid

Backtests are only as good as their assumptions. Watch for look ahead bias, survivorship bias, data snooping, overfitting, and ignoring transaction costs. Split data into in sample and out of sample periods, use walk forward validation, and test across markets and timeframes. For more on overfitting, see Investopedia’s overview of overfitting.

Measuring performance: beyond absolute returns

Judge strategies by the path of returns and their quality. Review Sharpe and Sortino, maximum drawdown, profit factor, win rate, and expectancy. Consider turnover and average holding period for feasibility. Stability across regimes often beats a few outlier months. Obside’s analytics surface these metrics in backtests so you can decide quickly what deserves paper trading.

Tools and platforms for algorithmic trading

You can build with code or use a platform. Code first in Python, pandas, NumPy, and backtrader for full control, or go platform first for speed. Obside stands out by compressing the pipeline into a conversational interface that creates alerts, strategies, and portfolios you can backtest and deploy in minutes. Explore our overview of automated trading bots for more examples.

Create a BTCUSD strategy on the 2h chart.

Buy when Supertrend turns bullish and RSI < 65.

Place a 5 ATR trailing stop and exit on a Supertrend flip.

Skip entries if daily volume < 20-day average.Actionable step-by-step: build your first strategy in one afternoon

Pick one market and timeframe you know. Decide between trend following or mean reversion and write clear rules. Open Obside and ask the Copilot to create your strategy from your description. Backtest three to five years, record core metrics, add one simple filter if results are erratic, and avoid piling on conditions.

Paper trade two to four weeks, compare fills with backtests, and adapt execution if slippage is high. Set global risk rules such as “If portfolio drawdown reaches 10 percent, stop trading and alert me.” When ready, connect your broker or exchange and start small. Review weekly and iterate.

Benefits and considerations of algorithmic trading

Algorithmic trading enforces discipline, frees you from screen watching, scales across markets, and turns hunches into testable rules. Backtesting lets you learn quickly and cheaply, while automation provides speed and consistency.

There are trade offs. Data quality and latency matter, costs erode returns, overfitting lurks, and reliability is essential. Obside addresses these by handling infrastructure, providing fast tests, and unifying technical and event data in one place so you can move from idea to execution quickly.

Conclusion: your next steps to build a repeatable edge

Algorithmic trading is practical for any trader who wants clarity, consistency, and speed. Start simple, write rules, test honestly, paper trade to surface issues, then automate with strict risk limits. Keep iterating as conditions evolve.

If you want to go from idea to execution in seconds, try Obside. Ask the Copilot to build your alert or full strategy in plain language, backtest instantly, and then run it with your connected brokers and exchanges.

To see the product in action and learn how it fits your workflow, visit the Obside website.

Frequently Asked Questions about algorithmic trading

Do I need to know how to code to start algorithmic trading?

No. Coding offers flexibility, but modern platforms let you build and deploy without writing code. With Obside, you describe rules in plain language and the system translates them into alerts, orders, and portfolio logic.

What is a realistic expectation for returns in algorithmic trading?

Returns vary by market, timeframe, and risk. Focus on stable risk adjusted returns, smooth equity curves, and reasonable drawdowns. Be skeptical of extreme returns with small samples. Start small live and scale after several months of consistent behavior.

How do I avoid overfitting my strategy?

Use out of sample tests and walk forward analysis. Keep parameters few, test across related assets and periods, and prefer simple rules with economic sense. Document your hypothesis before testing. Obside’s fast backtests help exploration, but discipline is essential.

What is the difference between algorithmic trading and high frequency trading?

High frequency trading is a narrow subset that operates at very low latencies with specialized infrastructure. Most individuals run slower strategies, from seconds to days, and can still benefit from automation.

How much capital do I need to begin?

You can start small in markets with fractional shares or crypto. Size so that drawdowns are tolerable and fees do not dominate. Paper trading first helps refine the approach.

Can I combine technical indicators with news or macro data in one strategy?

Yes. Many robust strategies combine technical context with events. For example, take technical entries after a macro confirmation or reduce exposure during scheduled risks. Obside supports both in one rule set so you can test and deploy the combination.