Crypto Trading Bots: How They Work and Build One Fast Today

Discover how crypto trading bots work, the best strategies, and how to build one in minutes. Learn automation tips and tools to trade 24/7 with discipline.

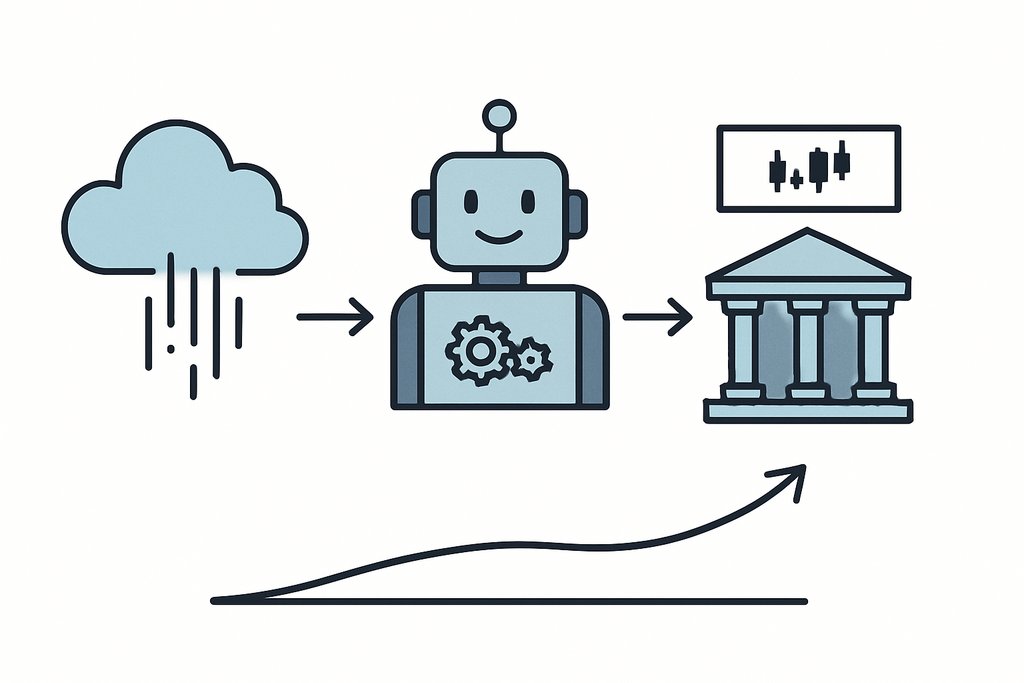

If you are searching for crypto trading bots, you are probably trying to solve a few very real problems. Crypto trades 24 hours a day, prices can move in seconds, and sticking to a plan is hard when emotions kick in. A well built bot watches the market for you, executes the plan without hesitation, and reacts instantly. In this guide, we will unpack exactly what crypto trading bots do, how to choose or build one, which strategies make sense, and how to turn an idea into a live, automated system you can monitor and refine.

Table of contents

- What is a crypto trading bot?

- How crypto trading bots operate

- Strategy playbook for crypto trading bots

- Backtesting crypto trading bots the right way

- Building a crypto trading bot with plain language on Obside

- Benefits of crypto trading bots and the considerations that matter

- Choosing a crypto trading bot platform

- Actionable next steps

- Frequently asked questions about crypto trading bots

- Related articles

What is a crypto trading bot?

A crypto trading bot is software that automates trading decisions and order execution based on predefined rules or learned patterns. Instead of watching charts all day, you specify conditions such as price crosses, indicator values, or news events, then let the bot place, modify, and cancel orders for you on connected exchanges.

Beneath the surface, a bot ingests data, evaluates signals, decides on actions, and manages risk. Many bots follow simple rule logic like buy when RSI crosses above 50 and trend is up. Others are more sophisticated, combining multiple timeframes, volatility filters, and position sizing rules to adapt to changing market regimes.

If you already manage alerts manually, think of a crypto trading bot as the next step. It turns alerts into automatic actions that fire without delay, with consistent sizing and risk controls. That consistency is where automation often outperforms manual trading. To understand the broader context, see our primer on automated trading.

How crypto trading bots operate

Although implementations vary, most crypto trading bots share the same core components. Understanding them helps you design better systems and evaluate platforms that promise automation.

Data intake

The bot consumes price series, order book snapshots, and sometimes funding rates and on chain data. Many traders also use technical indicators such as Relative Strength Index, moving averages, MACD and Supertrend. For a refresher, see concise references for the Relative Strength Index and MACD. Event driven traders also listen to news feeds, social posts, and economic releases.

Signal generation

This is where logic lives. It can be deterministic rules like close a long if price closes below the 50 EMA, statistical models that detect mean reversion, or pattern recognition that flags divergences. Signals often blend multiple inputs to avoid false positives, for example only take a momentum entry if volatility is not elevated and higher timeframes agree.

Execution

Execution is what separates a pretty backtest from real world performance. Good bots handle order types, place stops and targets atomically when possible, and account for slippage and fees. A liquid market might fill you near your signal price, while thin books and fast moves can push fills away from the backtest assumption. Learning about slippage will give you realistic expectations.

Risk management

Risk management is the spine of any durable bot. This includes stop losses, trailing stops, position sizing rules tied to volatility, and exposure caps across the portfolio. A sound approach defines the maximum loss per trade and the maximum drawdown the system is willing to accept.

Infrastructure and monitoring

Crypto markets never sleep, so uptime and observability matter. You want status checks, detailed logs, and real time alerts when conditions or performance drift. When you run bots through a platform, this part is handled for you.

Great automation marries clear rules with fast, reliable execution and strict risk limits.

Strategy playbook for crypto trading bots

There is no single best crypto trading bot. What works in a trend can suffer in a range, and vice versa. The key is to match logic to market structure and add filters that prevent trading in bad conditions. Here are proven categories to consider, with the nuances that make them robust.

Trend following

Trend following bots ride directional moves. A simple framework buys when a medium term moving average turns up, price breaks out above recent highs, and momentum confirms through RSI or MACD. To reduce whipsaws, add a higher timeframe filter and a volatility gate that avoids trades right after a large move. Targets can be partial takes at fixed multiples of risk or dynamic exits that trail by average true range.

Mean reversion

Mean reversion bots fade extremes. A classic example sells into overbought reads and buys into oversold reads when price is contained in a range. These work best when you combine a range regime detector with narrow volatility and avoid trending conditions. Position sizes are often smaller and exits sooner because reversals can be brief.

Breakout and retest

Breakout and retest bots target fresh expansions. They wait for consolidation, then enter on a break with an initial stop beyond the structure. If the breakout runs, they pyramid carefully as volatility expands. If the break fails and price retests the range, the system can either exit or flip direction, but only if regime filters still agree.

Event driven

Event driven bots react to scheduled or unscheduled catalysts. Scheduled events include funding rate flips, token unlocks, or economic prints that affect crypto sensitivity to risk. Unscheduled events include news headlines and influential tweets. With a proper feed and tight risk controls, event bots can capture short windows of edge. The practicality depends on how fast your platform can detect and act.

Market making and arbitrage

Market making and arbitrage bots are specialized. They require precise execution, fee structure advantages, and careful inventory hedging. If you are starting out, stay with directional or swing frameworks until you have the infrastructure and data to support these.

Backtesting crypto trading bots the right way

Before any bot touches live capital, you need to validate it on historical data and stress test it. Backtesting is the simulation of your strategy on past prices to estimate performance. A useful primer on backtesting concepts is available on Wikipedia.

A solid backtest uses realistic assumptions. Include trading fees, model slippage, and use candle close logic when your rules depend on confirmed closes. Avoid peeking into the future by only using information available at the decision time. Split your data into in sample for design and out of sample for validation. If you tune many parameters, you are at risk of overfitting. The more knobs you twist to make history look good, the more brittle the bot will be when markets change.

Look beyond headline returns. Study drawdowns, win rate, profit factor, average trade duration, exposure, and sensitivity to parameter changes. Robust strategies tend to work in neighboring parameter ranges, not only at a razor thin setting.

This is where a platform with fast backtesting and live execution can save you days. On Obside, the ultra fast engine lets you iterate a strategy idea in seconds, then deploy it to your connected exchanges when you are satisfied. Because you move from idea to execution in one place, the logic you test is the logic that runs, which helps reduce implementation drift. If you want a broader framework for building and automating, see our trading strategy guide.

Building a crypto trading bot with plain language on Obside

Many traders never automate because they feel they need to code. With Obside, you can describe what you want in plain language, and the platform converts it to working logic that you can test and run. Awarded the Innovation Prize 2024 at the Paris Trading Expo and supported by Microsoft for Startups, Obside focuses on speed from idea to execution.

Here is how to create a simple yet robust crypto trading bot in minutes.

Describe your rule in Obside Copilot

In the chat, write something like: When Bitcoin on the 2 hour chart closes above the 100 EMA, and RSI is below 70, open a long. Place a stop loss at 2 times ATR and take profit at 3 times ATR. Close the position if the 2 hour Supertrend flips bearish. The assistant will translate this into an executable strategy.

Add filters to improve quality

Ask Copilot to only allow entries when the 8 hour trend is bullish or when daily volume is above its 20 day average. You can also include event conditions such as avoid entries around major economic releases or increase caution when volatility spikes. For a deeper overview of techniques that combine rules and data, read our guide to quantitative trading.

Backtest instantly

Run the backtest across multiple coins and timeframes. Review equity curves, drawdowns, and a distribution of trade outcomes. If you see clusters of losses during high volatility, add a volatility filter. If exits are too early, adjust the trailing stop multiplier.

Connect your exchange and go live

Link your exchange account within Obside and choose between paper trading or live trading. Start small, monitor fills and behavior, and compare live metrics to your backtest baseline. If you want to practice first, follow our complete guide to paper trading.

Monitor and iterate

Set alerts for deviations such as slippage above a threshold or a losing streak beyond expectations. Adjust and redeploy quickly. Because Obside merges alerts, strategies, and execution, you can also spin up targeted alerts such as alert me if Bitcoin rises above a level with doubled daily volume or notify me if RSI crosses 70 on ETH and MACD turns bearish to complement your bot. For a broader introduction to building bots end to end, see our trading bot guide.

Enter when the 2 hour Supertrend turns bullish and RSI is between 40 and 65, with 8 hour Supertrend confirmation. Stop at 5 ATR on 2 hour, then trail by 3 ATR after price moves 2 ATR. Exit on Supertrend flip or trailing stop. Backtest and run on paper for one week before sizing up.

Scan for coins with 20 day ATR below a threshold. Enter long when price tags the lower Bollinger Band and RSI on the 30 minute chart is below 35, provided the 4 hour trend is flat. Exit at mid band or when RSI mean reverts to 50. Cap daily trades per symbol.

Buy a small amount if price dips more than 3 percent within 10 minutes on high volume and a relevant positive news headline is detected. Use tight risk and quick exits. On Obside, combine price, volume, and news topics without writing code.

Benefits of crypto trading bots and the considerations that matter

Crypto trading bots offer clear benefits when used thoughtfully. The biggest is discipline. A bot executes your plan without hesitation, fatigue, or fear. It brings consistency to entries and exits, which often translates into more stable results over time. Bots also scale your attention. You can monitor many coins and timeframes at once, something that is impossible manually.

- Consistent execution of rules

- 24/7 monitoring and reaction speed

- Scales across assets and timeframes

Speed is another edge. News and technical breaks can happen quickly. With a bot, the time from signal to order can be milliseconds, which can be the difference between getting in at a good price and chasing the move. Platforms like Obside push this advantage further by converting plain language intent into live orders connected to your exchanges.

There are important considerations too. Overfitting is a silent killer of bots. Fight this by using clean logic, out of sample validation, and minimal optimization. Transaction costs and slippage eat edges fast. Always include them in tests and prefer assets with enough liquidity to support your trade size. Infrastructure matters as well. Exchange downtime, API rate limits, and network hiccups can disrupt execution.

Choosing a crypto trading bot platform

If you are picking a platform instead of building from scratch, focus on what impacts live performance and your ability to iterate. Look for fast and realistic backtesting, native connections to your exchanges, robust risk controls, and transparent logging. You want flexible condition building that goes beyond basic indicators, support for multi timeframe and multi asset logic, and the ability to blend technical and event driven inputs.

Obside is designed around these needs. You can chat in plain language to define alerts, automate orders, or manage entire portfolios based on your rules. Whether you trigger actions from prices, indicators, news, or macro data, Obside executes in real time. For example, buy 50 dollars of Bitcoin every Monday at 10:00, keep 50 percent of the portfolio in BTC, 25 percent in ETH and 25 percent in USDC, or sell all positions if the S&P 500 drops by 10 percent. The marketplace lets you discover strategies shared by traders and adapt them to your own risk. For a broader view of AI driven workflows, see our overview of AI trading.

Actionable next steps

Start with a single, simple idea. Pick a coin and a timeframe you understand, and sketch a rule set you can explain in one sentence. Backtest it with fees and slippage, then paper trade it live for at least a week.

Once you have a baseline, add one improvement at a time. Introduce a trend filter, switch to ATR based stops, or add a trailing exit. Avoid changing many things at once, or you will never know what helped.

When you are ready to automate, try Obside. Open an account, describe your strategy to Obside Copilot in plain language, backtest in seconds, connect your exchange, and go live with small size. Monitor, iterate, and scale gradually. If you want a no code blueprint for equities too, read our guide to an AI stock trading bot.

Prefer to explore first and see live examples from other traders along with the marketplace of shared strategies and alerts.

Frequently asked questions about crypto trading bots

How profitable are crypto trading bots?

Profitability depends on the strategy quality, execution, and market conditions. Some bots can produce attractive risk adjusted returns when they follow clear edges and apply solid risk management. Others underperform if they are overfit or run on illiquid pairs. Treat a bot like a trading strategy, not a money machine, and judge it by robust metrics such as drawdown, Sharpe ratio, and profit factor over a meaningful sample.

Do I need to know how to code to run a crypto trading bot?

No. Platforms like Obside let you describe strategies in plain language and convert them into executable bots. If you prefer more control, you can still code, but it is no longer a requirement to automate alerts, orders, and portfolio rules.

Are crypto trading bots safe?

A bot is as safe as the rules you define and the platform you use. Focus on risk limits, conservative sizing, and stop losses. Use platforms that offer detailed logs, permission based connections to exchanges, and real time monitoring. Start with paper trading, then small capital, and scale only after live performance matches expectations.

What indicators work best for crypto trading bots?

There is no universal best. RSI, moving averages, MACD, ATR, and Supertrend are popular building blocks. What matters is how you combine them with filters such as higher timeframe confirmation, volatility thresholds, and risk rules. Test your ideas thoroughly and keep logic simple. To get started with the foundations, see our guide on buy and sell trading rules.

How much capital do I need to start?

You can start small. Many exchanges allow low minimum order sizes, and platforms like Obside support fractional and fixed dollar orders. Begin with an amount you can afford to risk while you validate your approach, then size up gradually as your confidence and track record grow.

Related articles

- AI Stock Trading Bot: From Signals to Real Trades, No-Code

- Trading Bot Guide: Automate Strategy from Idea to Execution

- Automated Trading: What It Is, How It Works and Start

- AI Trading: Turn Signals into Automated Market Actions

- Quantitative Trading: Build, Test, and Automate Strategies

- AI Trading Bot: What It Is and How to Build One That Trades

- Buy and Sell Trading: A Practical, Proven Guide to Rules

- Types of Trading: Strategies, Styles, and Examples

- Trading Strategy: Build, Test, and Automate Rules That Last

- Paper Trading: Complete Guide to Practice Strategies

- Investment Guide: Build Wealth in Any Market | Step-by-Step

- Bitcoin Investment Calculator: Plan Your BTC Strategy

- Autopilot Investment App: A Complete Hands-Off Guide

- AI Investing: From Hype to Practical Strategies That Work

- Investment Strategies: Build, Test, and Automate Yours

- How to Invest: A Practical Guide to Start and Succeed

- Forex Trading Guide: How the Currency Market Works

- Trading in 2025: Strategies, Tools and Day Trading Guide

- AI Stocks: How to Invest and Profit from the AI Boom

- Best Stocks to Buy Now: A Practical Investor Guide