Trading Strategy: Build, Test, and Automate Rules That Last

Learn what a trading strategy is, how to design and backtest rules, and how to automate execution so you can move from idea to action fast with Obside.

What you’ll learn

- Define clear, testable trading rules

- Choose markets, timeframes, and risk parameters

- Backtest honestly and avoid overfitting

- Automate alerts and orders with Obside

Table of contents

- What is a trading strategy?

- Why a trading strategy matters right now

- The core components of a trading strategy

- Types of trading strategies that actually work

- Step-by-step: build your first trading strategy

- From rules to real-time execution with Obside

- Risk management and position sizing

- Backtesting without fooling yourself

- Practical strategy examples you can deploy

- Benefits and considerations

- Conclusion and next steps

- FAQ: trading strategy

- Related articles

What is a trading strategy?

A trading strategy is a repeatable set of rules that defines how you enter, manage, and exit positions. It specifies what markets you trade, which timeframe you operate on, the conditions that trigger trades, how much you risk, and how you measure results. A robust strategy removes ambiguity so that two people following the same rules can expect similar outcomes.

Formal rules are not only for algorithmic traders. Even discretionary traders benefit from a written playbook. Rules reduce the impact of stress, fatigue, and fear of missing out. They also allow you to backtest and analyze whether your edge is real, then deploy it with confidence.

Why a trading strategy matters right now

Markets move quickly and the flow of information has exploded. Prices react to news, macro data, social media, and cross-asset flows in minutes. Without a structured approach, it is easy to enter late, exit early, or size trades inconsistently. A clear trading strategy gives you a roadmap so you can act fast without improvising.

Modern tools make this even more powerful. With Obside, a financial automation platform, you can describe your strategy or alert logic in plain language and have it executed automatically in real time. Think of it as moving from idea to action in seconds, backed by ultra-fast backtesting to validate your rules before you commit capital. For a broader view of tools and workflows, see Trading in 2025: strategies, tools, and day trading guide.

The core components of a trading strategy

Every sound trading strategy is built on a few pillars. Understanding each one helps you design better rules and avoid common traps.

Market and timeframe selection

Decide what you will trade and where your edge lives. A strategy that works on large-cap equities may not translate to microcaps. A system that works on a 5 minute chart can fail on daily data. Be explicit about instruments and timeframes. If you are new to currencies, our Forex trading guide is a helpful primer.

Entry criteria

Define the exact conditions that trigger a trade. This could be technical patterns, indicator thresholds, price action structures, or event-driven signals. For example, a trend-following entry might wait for price to break above a 50 day high with rising volume, while an event-driven entry might react to an earnings surprise.

Exit criteria

Decide how and when to get out. Use a stop loss to limit risk and a profit-taking plan to lock gains. You can exit based on price targets, trailing logic like Average True Range, or signal reversal. Exits often shape your equity curve more than entries.

Risk management

Determine position size, maximum risk per trade, and total portfolio risk. Many traders risk between 0.5 percent and 2 percent per trade. Concepts like R multiples, expectancy, and risk of ruin are central. Learn more about expectancy on Investopedia.

Position sizing

Decide how to adjust size based on volatility or conviction. Fixed fractional sizing is simple and robust. Volatility targeting uses an indicator like Average True Range to normalize risk across instruments. Read about ATR on Investopedia.

Performance measurement

Track win rate, average win, average loss, profit factor, maximum drawdown, Sharpe ratio, and time in market. The Sharpe ratio is explained on Investopedia.

Process

Document how you scan for setups, place orders, manage trades, and review performance. A strategy is a living system refined through feedback loops. A regular review cadence keeps you honest.

Types of trading strategies that actually work

There is no single best trading strategy. What works depends on temperament, time availability, and risk tolerance. These four families have stood the test of time.

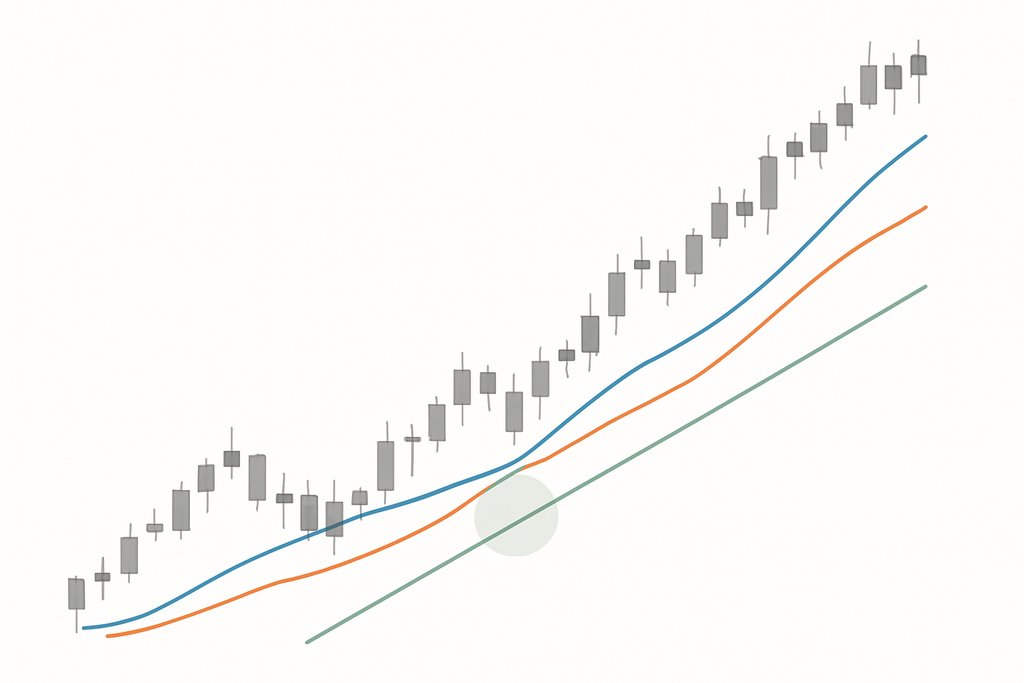

Trend following

Ride persistent moves. Entries often follow breakouts or moving average crossovers. The key is to let winners run while cutting losers quickly. Expect lower win rates and larger payoffs on winners.

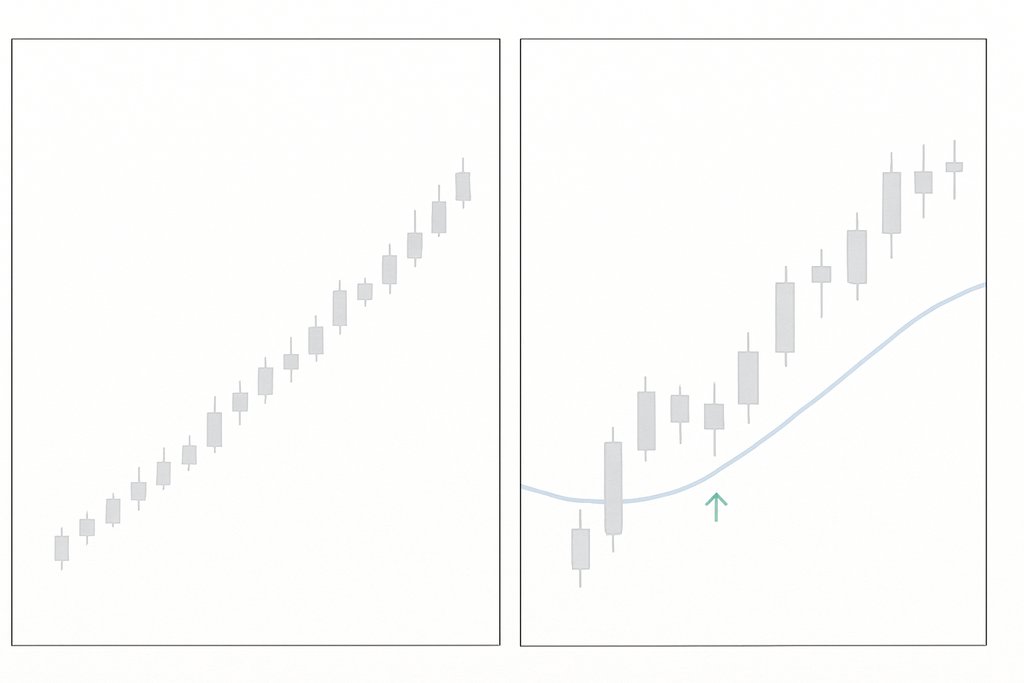

Mean reversion

Prices often revert toward a mean after short-term extremes. Entries might use indicators like RSI or Bollinger Bands to identify stretched conditions. The edge comes from snapbacks in range-bound markets. Review RSI basics to tune thresholds.

Breakout and momentum

Look for volatility expansions from consolidations. Entries occur when price clears a well-defined level, ideally with rising volume. Momentum thrives on strong themes and catalysts.

Event-driven

Trades are triggered by events such as earnings surprises, macro releases, or news. Automation shines here. If a company guides higher or a central bank shifts policy, your strategy can react in seconds and still apply technical filters to reduce noise. See practical ideas in AI investing strategies.

Step-by-step: build your first trading strategy

Start small, be explicit, and keep your rules testable. Follow this path to ship your first system.

Step 1. Choose your market and timeframe

Pick one instrument and one timeframe to reduce noise. For example, start with EUR/USD on the 1 hour chart, or Apple on daily bars.

Step 2. Define your setup

Suppose you choose a trend-following approach. Your entry could be a close above the 50 period moving average when the slope of the 200 period average is positive. Add a volume filter or an indicator like MACD for confirmation. Learn about MACD on Investopedia.

Step 3. Write precise entry and exit rules

Example entry rule: go long if price closes above the 50 period SMA, the 50 is above the 200, MACD histogram is positive, and the last swing high is broken by at least 0.5 ATR. Example exit rule: initial stop at 2 ATR below entry, trail the stop by 2.5 ATR, and take partial profit at 1.5 R.

Step 4. Set position size

Risk 1 percent per trade by sizing your position so that if the stop is hit, you lose 1 percent of equity. If ATR is 2 dollars and your stop is 4 dollars away, position size equals 1 percent of equity divided by 4 dollars per share.

Step 5. Backtest

Test your rules on at least five years of data or 500 trades, whichever is larger. Include transaction costs and realistic slippage. Avoid peeking into future data. Split into in-sample for development and out-of-sample for validation.

Step 6. Review and refine

Evaluate performance metrics and equity curve behavior. If the strategy only works in a specific regime, be clear about when to deploy it. Avoid excessive optimization. Simple rules often generalize better.

Step 7. Automate and monitor

Once you have a positive expectancy system, automate execution to remove hesitation. Automation lets you run multiple strategies in parallel without missing signals. If you want to practice first, read our paper trading guide.

From rules to real-time execution with Obside

Obside turns plain-language instructions into smart alerts, automatic orders, and fully automated strategies. Instead of writing code, describe your rules to Obside Copilot and let the system execute them with your broker or exchange after instant backtesting.

“Alert me if Bitcoin rises above $150,000 and daily volume doubles.”

“Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish.”

“Buy $1000 of Bitcoin if the price is below $100,000.”

Imagine a swing strategy on Bitcoin: buy when there is a bullish RSI divergence on the 15 minute chart, set a stop at the low of the day, and take profit at 10 percent. Obside interprets the conditions, backtests in seconds, and if the results fit your goals, runs the rules live. You can add a trailing stop at 5 ATR or close the position if RSI becomes overbought.

The platform supports multi-timeframe logic. For example, when the Supertrend turns bullish on the 2 hour chart, if RSI is not overbought and the 8 hour Supertrend is also bullish, then buy. For selling, use the reverse logic. Place a trailing stop loss at 5 ATR on the 2 hour chart and close the position if the 2 hour Supertrend changes direction.

Ready to try it now? Access the platform at beta.obside.com or create your account at beta.obside.com/register.

Risk management and position sizing for your trading strategy

The best entry rules cannot save a strategy that risks too much. Risk management keeps you in the game long enough for your edge to play out.

Set a maximum risk per trade. Many traders settle between 0.5 and 1 percent. This helps keep drawdowns manageable.

Use volatility-aware stops. ATR based stops adapt to instrument volatility, helping normalize risk across assets.

Diversify across uncorrelated strategies. For example, run a daily trend follower on futures alongside an intraday mean reversion system on equities. Diversification is not a guarantee, but it often smooths the equity curve.

Be careful with leverage. It amplifies both returns and losses. If you use it, size down so your percentage risk per trade remains constant.

Explore Kelly-based sizing as an upper bound, not a target. The Kelly Criterion assumes knowledge that is rarely available. A half-Kelly or fixed fractional approach is usually more robust.

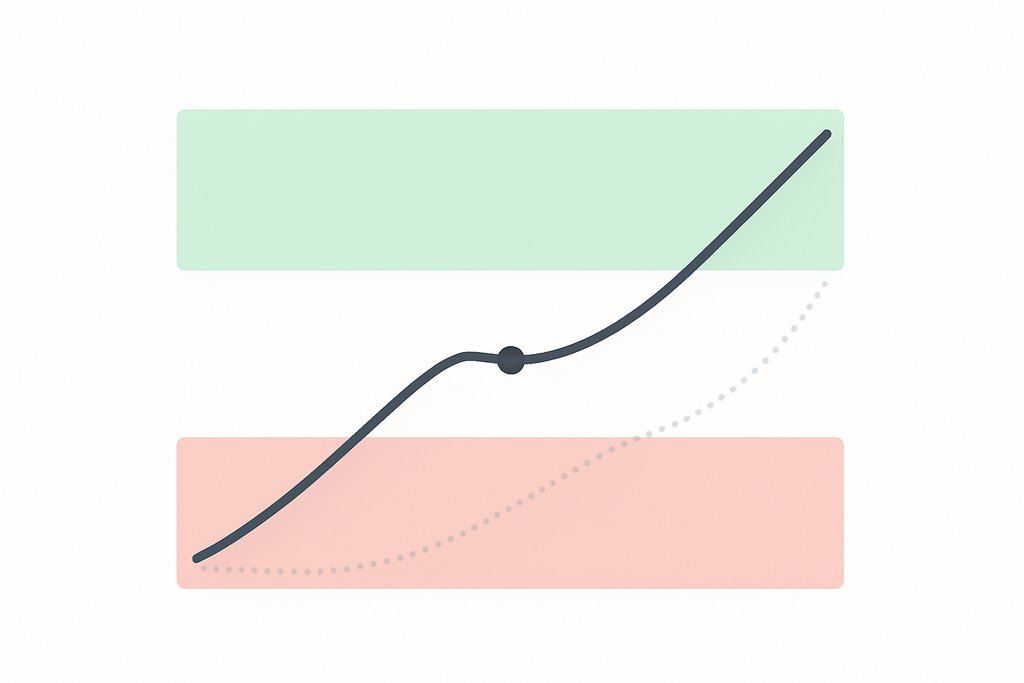

Backtesting your trading strategy without fooling yourself

Backtesting is your first line of defense, but it is easy to overfit. Keep your process clean.

Include costs and slippage in every test. Neglecting them can turn a loser into a fake winner. Use conservative slippage assumptions for illiquid instruments or volatile events.

Avoid data snooping. Do not test countless indicators and parameters until something works, then declare victory. The more you search, the more likely you are to find noise.

Use out-of-sample validation. Develop on one period, then test on a later period you have not touched. Monte Carlo resampling helps you understand how volatile results could be.

Check robustness. Small parameter changes should not collapse performance.

Monitor live performance. Paper trade first to compare real-time behavior against backtests. If slippage is worse than expected or signals arrive late, adjust assumptions. Start with our complete paper trading guide.

The efficient market hypothesis suggests it is difficult to beat the market consistently. It is a reminder to stay humble, not a reason to give up. Learn more on Wikipedia.

Practical trading strategy examples you can deploy

To bring it together, here are concrete examples that blend technical and event-driven logic.

Daily trend follower on equities

Enter long when price closes above the 100 day moving average and the average is rising. Require the last breakout to occur on above-average volume. Stop at 2.5 ATR, trail by 2 ATR, and take profit on a close below the 50 day average.

Intraday mean reversion on ETFs

Enter long when RSI(2) dips below 5 and the broader daily trend is up. Exit when RSI(2) returns above 60 or at the close. Keep size small and use tight stops since intraday mean reversion can fail in trending sessions.

Event-driven crypto momentum

If Bitcoin breaks to a 30 day high within 60 minutes of a major macro headline or large on-chain inflow, enter with half size. Add the second half if price holds above the breakout level for one hour. Exit on a close back inside the prior range. You can automate this in Obside by linking news triggers and on-chain data with price filters. For scenario planning, try the Bitcoin investment calculator.

Portfolio allocation rule

Keep 50 percent in Bitcoin, 25 percent in Ethereum, and 25 percent in USDC. Rebalance monthly or when any allocation deviates by more than 5 percent. Obside can monitor allocations and rebalance automatically on schedule or when thresholds are breached. If you prefer a hands-off approach, see our autopilot investing guide.

Benefits and considerations of a defined trading strategy

The primary benefit is clarity. You know exactly what to do, when to do it, and how much to risk. Consistency improves your odds of capturing edge and makes performance measurable.

Speed is another benefit, especially with automation. If your rules are codified, you can respond in real time. With Obside, you can set alerts like “notify me if RSI crosses 70 on EUR/USD and MACD turns bearish” and tie them to actions to reduce risk or flip position automatically when rules confirm.

There are important considerations. No strategy works in all markets. Drawdowns are inevitable. Over-optimization is a constant risk. Data quality matters. Even with automation, you need oversight. The answer is not to abandon rules, but to build processes for monitoring, reviewing, and adapting. For a structured framework, explore our investment strategies guide.

Conclusion: your next steps to a smarter trading strategy

Pick one market and timeframe. Write your entry, exit, and risk rules on a single page. Backtest with realistic assumptions. Paper trade to validate execution. When satisfied, automate to remove hesitation and improve consistency.

If you want to move from idea to action quickly, describe your rules in plain language to Obside Copilot. Create alerts in seconds, test strategies at high speed, and connect execution to your broker or exchange so your plan runs even when you are away from the screen. Start with a simple instruction like “buy $1000 of Bitcoin if the price is below $100,000 with a stop at 2 ATR and a trailing stop at 1.5 ATR,” review the backtest, then deploy live if it fits your goals.

Want to learn more about how Obside turns natural language into real market actions, from alerts to full strategies? Explore the platform overview.

FAQ: trading strategy

What is the simplest trading strategy for beginners?

A moving average crossover on a single market and timeframe is a great start. Go long when the 20 day simple moving average crosses above the 50 day, exit when it crosses back below, and cap risk with a 2 ATR stop. It is easy to test and teaches you about trends and drawdowns.

How do I know if my trading strategy actually works?

Measure expectancy and risk-adjusted returns. Look for a positive profit factor, reasonable drawdown relative to return, and robustness to small parameter changes. Validate on out-of-sample data and paper trade before going live. Track metrics like Sharpe ratio and maximum drawdown.

Should I automate my trading strategy?

If your rules are clear and testable, automation reduces errors and missed signals. It also lets you run multiple systems without babysitting charts. Platforms like Obside let you write instructions in plain language and handle alerts, orders, and risk management automatically after backtesting.

How much capital do I need to start?

You can start small as long as you can size positions and cover transaction costs. Focus on percentage risk per trade rather than absolute dollars. A consistent process with sound risk management matters more than starting size. If you are investing more broadly, see how to invest and our step-by-step wealth guide.

What indicators should I use in a trading strategy?

Indicators are tools, not magic signals. Choose a few that match your style. Trend traders often use moving averages, ADX, and breakouts. Mean reversion traders use RSI and Bollinger Bands. Whatever you pick, define exact rules, test them, and avoid overlapping signals.