Types of Trading: Strategies, Styles, and Examples

A practical map of trading styles by time horizon, decision process, and instruments, with examples you can test and automate in seconds using Obside.

What you’ll learn

- How time horizon, decision style, and catalysts fit together

- Which trading types match your time and temperament

- Examples you can test and automate with Obside

- A simple plan to choose, test, and scale a strategy

Table of contents

- What do we mean by types of trading?

- Popular types of trading by time horizon

- Types of trading by decision style and strategy

- Event driven types of trading and catalyst setups

- Types of trading by instrument and market

- Practical examples and a step-by-step plan

- Benefits and key considerations

- Conclusion and next steps

- FAQ: Types of Trading

- Related articles

What do we mean by types of trading?

If you are searching for types of trading, you are likely trying to match your goals, time, and risk tolerance with a concrete approach you can actually execute. The trading world is vast and full of labels that sound similar yet behave very differently in practice. Pick a style that does not fit your life or personality and you will fight yourself as much as the market. Choose well and your process becomes clear, your rules make sense, and your results become easier to measure and improve.

This guide breaks down the main types of trading in a practical way, from time horizon to decision style and instruments. You will see how these types translate into day to day actions, how to test them quickly, and how to automate them with tools like Obside so your ideas turn into market actions in seconds. No fluff, just a structured map of the trading landscape with real examples you can try.

When traders discuss types of trading, they often blend three dimensions. The first is time, how long you hold positions. The second is decision style, how you choose entries, exits, and risk. The third is catalyst or instrument, what moves you act on and what you trade. Treating these as separate layers gives you clarity. You can be a swing trader by time horizon, systematic by decision style, and event driven by catalyst, all at once.

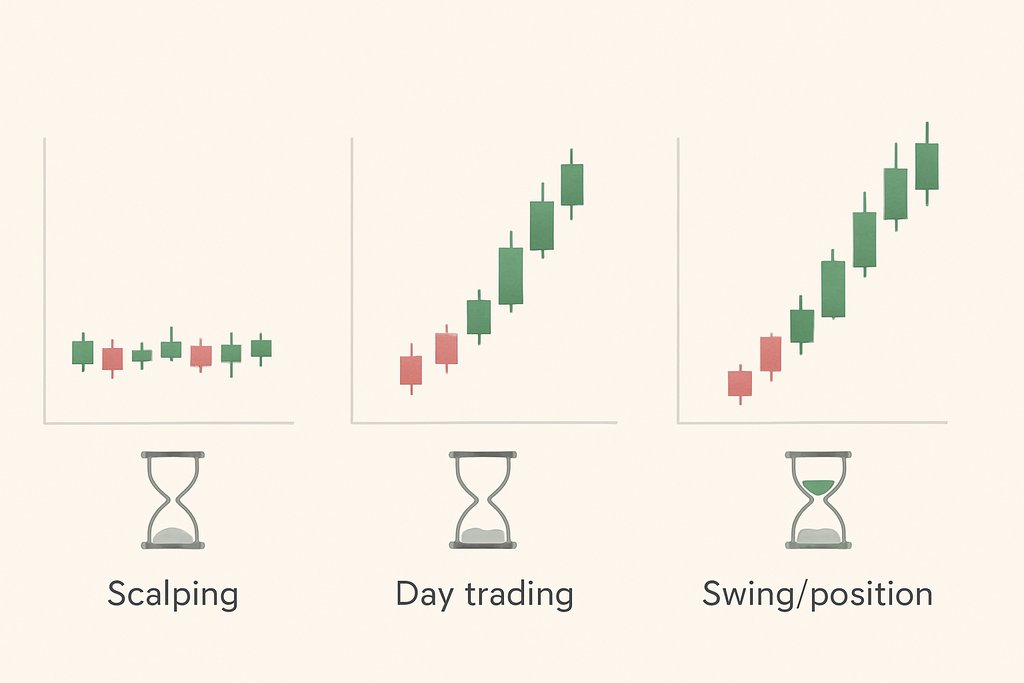

Popular types of trading by time horizon

The simplest way to classify types of trading is by how long you hold positions. Each horizon changes the rhythm of your day, your data needs, and your risk profile.

Day trading

Day trading keeps positions within the same trading session. You open and close before the market closes. This style favors liquid assets with tight spreads and clear intraday patterns. Day traders often rely on tools like VWAP, opening range breakouts, and momentum indicators. If you have the time to focus for several hours and enjoy fast feedback, day trading might fit. It requires discipline with stops and a consistent routine around entries and exits. For a primer on the basics, see this overview of day trading on Investopedia, and explore intraday tools in Trading in 2025.

Scalping

Scalping is the shortest of all holding periods, sometimes just seconds to minutes. Scalpers seek small, repeatable edges and rely on speed and precision. Costs and slippage matter a lot, since you place many trades with small targets. This style suits traders who prefer high frequency decisions, a clear rule set, and reliable execution.

Swing trading

Swing trading holds positions for several days to a few weeks. You aim to capture a chunk of a move without needing to watch every tick. Swing traders use daily or 4 hour charts, combine trend and momentum signals, and respect broader support and resistance. If you have a day job or prefer a calmer schedule, this style can be a strong match. Read about common swing frameworks on Investopedia, then turn rules into tests in our guide to building and automating strategies.

Position trading

Position trading extends to months or longer. This style aligns with larger trends, macro themes, and company fundamentals. Position traders might use weekly charts, moving averages, and macro data to stay with longer moves and reduce noise. It suits patient traders who accept larger drawdowns and place fewer trades.

In practice, your time horizon shapes everything else. A day trader cannot reasonably rely on quarterly macro data to time an exit on a five minute chart. A position trader does not need to overreact to intraday spikes. Obside makes the time horizon explicit when you build a strategy. You can ask Obside Copilot to test a 2 hour momentum strategy for swing trading, then automate alerts and orders only in your preferred time window.

Types of trading by decision style and strategy

Another way to group types of trading is how decisions are made. Discretionary trading relies on the trader to read the chart, interpret news, and decide in real time. Systematic trading encodes the rules in advance so the computer follows them consistently. Algorithmic trading goes further, using automated execution and infrastructure to monitor, decide, and place orders at scale, as introduced in Wikipedia’s algorithmic trading article.

Trend following

Trend following seeks to ride moves in the direction of the prevailing trend. Simple moving average crossovers, Donchian channel breakouts, and Supertrend signals are common tools. The logic is simple, you buy strength in an uptrend and cut losers quickly. Trend following often pairs well with swing or position time horizons. See Investopedia on trend trading for background.

Mean reversion

Mean reversion assumes prices revert toward an average. Traders fade short term extremes, using tools like RSI, Bollinger Bands, or z score divergences. This style needs careful risk control because trends can extend further than expected. Review the basics in Investopedia’s mean reversion guide.

Breakout and momentum

Breakout and momentum trading focuses on surges through key levels with rising volume. You act when price clears a range or a technical barrier and use volume or breadth as confirmation. This style is common among day and swing traders because it turns consolidation into trades with clear invalidation points.

Statistical arbitrage and pairs

Statistical arbitrage and pairs trading look for relative value between correlated assets, like two bank stocks or ETF pairs. You go long the cheap one and short the expensive one, betting the spread normalizes. This approach is usually systematic, requires robust data hygiene, and benefits from frequent rebalancing.

Event driven

Event driven strategies act around catalysts such as earnings surprises, product launches, or macro announcements. The logic can be long volatility around events or specific directional bets based on expected outcomes. This style fits traders who can plan scenarios in advance and react fast to new information.

Obside helps you bridge these decision styles into action. You can encode a mean reversion rule as a natural language instruction, for example, buy EUR/USD when RSI crosses below 30 and then back above 30 on the 1 hour chart, place a stop at the recent swing low, and take profit at a 1.5 to 1 reward to risk. You can also build a trend following stack, when Supertrend turns bullish on the 2 hour and 8 hour charts, and RSI is not overbought, enter long with a trailing stop at 5 ATR.

Dig deeper after mapping your needs:

Event driven types of trading and catalyst based setups

Some traders define their edge by what moves they act on rather than how long they hold. Catalyst based types of trading include earnings releases, product launches, macro prints, and news. The art is to define the scenario, prepare your triggers, and control slippage and sizing.

Earnings and company events can lead to gaps and outsized moves. You might buy strength on a surprise beat with high volume or fade an overreaction when price overshoots fundamentals. Macro and commodity events include central bank decisions, inflation prints, energy inventory reports, or weather shocks. For example, buying oil when a hurricane threatens supply or adjusting bond exposure when inflation deviates from expectations. News and alternative data range from social media signals to regulatory filings and AI model announcements.

Obside was designed for this event driven reality. You can say, alert me if Apple announces a new product, or buy 50 dollars of Tesla if Elon Musk tweets about it. You can combine technical and news triggers, notify me if RSI crosses 70 on EUR/USD and MACD turns bearish, then place a stop at ATR 2. By tying conditions to prices, indicators, news, and macro data, Obside lets you react instantly, sell your stocks if new tariffs are announced, or rebalance allocations when volatility spikes. For an overview of event driven approaches, see Investopedia’s event driven strategy guide.

Types of trading by instrument and market

The instrument you trade also shapes your style. Equities and ETFs offer broad sector exposure and familiar behavior for many traders. Liquidity is deep in large caps, and patterns like gaps and earnings tend to matter. Forex offers 24 hour trading in highly liquid pairs like EUR/USD, with tight spreads and macro driven moves. If you are new to currency markets, start with our Forex trading guide to understand how the market operates. Crypto runs around the clock with higher volatility and can suit both trend and mean reversion setups. Futures and options add leverage and flexibility, letting you express views on direction, volatility, or relative value. For options basics, see Investopedia’s introduction to options.

While instruments open different tactics, your core framework remains the same. Decide on a time horizon, choose a decision style, define your catalyst, then standardize entries, exits, and risk. With Obside, you can keep the same rule set across multiple assets and brokers. The platform connects to your accounts so a strategy tested on Bitcoin can be adapted to Ethereum or an equity index ETF with the same logic and risk parameters.

Practical examples and a step-by-step plan

It is easier to internalize the types of trading when you see rules in action. Here are three examples across different horizons and styles, followed by a simple plan to build your own.

Monitor the opening range for the first 30 minutes. If price breaks above the high with rising volume and the broader index is green, enter long with a stop below the midpoint of the range and aim for a 1.5 to 1 reward to risk. Exit by end of day. In Obside, write: when the first 30 minute range breaks upward on AAPL with volume 150 percent of average, buy 100 dollars, set a stop at the range midpoint, take profit at 1.5 R, close by session end.

Track RSI on a 4 hour chart. When RSI dips below 30 and then crosses back above 30 on EUR/USD, go long, stop below the recent swing low, target the 20 day moving average. In Obside: buy 1,000 EUR/USD when 4 hour RSI crosses back above 30 after being oversold, stop at recent swing low, take profit at the 20 day SMA.

Set an alert for Bitcoin when daily volume doubles and price closes above a long term moving average. If both happen, add a position with a trailing stop to capture continuation. In Obside: alert me if Bitcoin rises above 150,000 dollars and daily volume doubles, then buy 500 dollars with a trailing stop of 5 percent.

Here is a simple plan to choose and implement your type of trading. Define your constraints and edge hypothesis. How much time can you spend each day, which markets do you understand, what data or pattern do you believe is your edge. Pick a time horizon that fits your life. If you cannot watch screens for hours, avoid day trading. If you want frequent practice, avoid monthly position trading.

Choose a decision style. If you prefer structure and consistency, go systematic. If you value discretion and pattern recognition, keep it discretionary but still write your rules. Turn your rules into precise conditions. Translate entries, exits, and risk into measurable signals. For example, instead of say buy when it looks strong, define buy when price closes above the 20 day high with volume above the 50 day average.

Backtest quickly, then forward test. Use Obside’s ultra fast backtesting engine to see if your rules had an edge across assets and phases. If results look reasonable, run the strategy small in real time with alerts and automatic orders through your connected brokers or exchanges. Iterate and scale. Review trades weekly, adjust rules cautiously, and increase size only when live results match tests. For a full blueprint, read our guide on building, testing, and automating strategies.

Benefits and considerations across the main types of trading

Each type of trading offers a different blend of flexibility, workload, costs, and psychological demands. Shorter horizons offer more trade frequency and quicker feedback, but they magnify execution costs and require tight discipline. Longer horizons reduce noise and costs, but patience is tested during drawdowns and you place fewer trades, which slows learning.

Systematic approaches bring consistency, help control emotions, and are easier to test, but they must be maintained and can underperform during regime shifts. Discretionary trading can adapt to unusual situations and leverage human pattern recognition, but it is harder to measure and improve without clear rules.

Event driven styles can capture big moves around catalysts, yet they face gaps, slippage, and sometimes low fill quality. You should understand slippage and drawdowns to see their impact on performance. See Investopedia on slippage and Investopedia on drawdowns.

Whatever your chosen type, risk management makes or breaks the strategy. Define your stop, position size, and maximum portfolio risk per idea. Test how your rules behave in volatility spikes, thin liquidity, and sudden news. Then automate the discipline. In Obside, you can build risk rules into every strategy, for instance, sell all positions if the S&P 500 drops by 10 percent, or rebalance to 50 percent Bitcoin, 25 percent Ethereum, and 25 percent USDC when volatility exceeds a threshold.

Conclusion and next steps

There is no single best type of trading. There is only a type that fits your time, temperament, and tools. Start with the three layer map, time horizon, decision style, and catalyst. Translate your ideas into concrete rules you can test in minutes. Keep the pieces that survive both backtests and live forward tests. Remove everything else.

If you want to move from idea to execution fast, try writing one rule you believe in and test it with Obside Copilot today. You will know within seconds if the logic holds up historically, and you can run it automatically through your connected brokers and exchanges with alerts, orders, and portfolio rules built in.

Prefer to explore features first and see how strategies are shared by other traders on the marketplace and dashboard.

FAQ: Types of Trading

What type of trading is best for beginners?

Beginners often do well with swing trading because it requires less screen time, uses higher timeframe signals that are cleaner, and gives you time to plan entries and exits. Start with a simple trend following or mean reversion rule set on liquid assets. Backtest the rules, trade small, and focus on consistency before size. Obside can help you test and automate routine parts so you can learn faster.

Can I combine different types of trading?

Yes, and many professionals do. You might run a swing trend following strategy in equities while also deploying a small event driven playbook around earnings. The key is to isolate rules, risk, and evaluation for each type. In Obside, create separate strategies and funding buckets so results are comparable and one approach does not interfere with the others.

How do I know if my trading type works?

You need both a backtest and a live trial. The backtest should show a logical equity curve, acceptable drawdowns, and robustness across assets and periods. Live trading, even with small size, confirms execution quality and psychological fit. Measure metrics like win rate, average reward to risk, and maximum drawdown, then compare them to the backtest. Obside’s ultra fast backtesting and automated execution make this loop quick to run.

What is the difference between swing trading and day trading?

Day trading closes positions by the end of the session and focuses on intraday patterns and momentum. Swing trading holds for days to weeks and aims to capture a portion of multi day moves. Day trading demands more screen time and stricter execution, while swing trading demands more patience and tolerance for overnight gaps.

Do I need to code to run systematic strategies?

No. With tools like Obside, you can describe your rules in plain language, backtest them in seconds, and execute them automatically with your connected brokers and exchanges. Coding can help with custom data or infrastructure, but it is not a requirement to be systematic anymore.