Backtest Portfolio: Validate and Improve Your Strategy

Learn how to backtest portfolio ideas the right way, avoid common pitfalls, and turn insights into real trades with a rigorous, practical workflow.

Most investors eventually ask a simple question with a complex answer: if I had invested this way before, how would it have worked? That curiosity drives the search for backtest portfolio. Whether you are weighing a 60/40 mix against risk parity, rotating crypto assets by momentum, or tilting toward quality stocks, you want objective evidence before you commit real money. A rigorous portfolio backtest moves you from guesswork to informed decisions and reveals both strengths and hidden weaknesses.

In this guide, you will learn how to backtest a portfolio the right way, avoid common traps, interpret results, and translate insights into live execution. You will also see how Obside’s ultra fast engine and conversational Copilot accelerate the process from testing to automation.

Table of contents

- What does it mean to backtest a portfolio?

- How to backtest a portfolio: essential workflow

- Metrics that matter

- Avoiding common backtesting pitfalls

- Backtesting methods from simple to advanced

- A practical step-by-step portfolio backtest

- How to backtest a portfolio with Obside

- Backtest portfolio examples used in practice

- Benefits and key considerations

- Actionable next steps

- References

- FAQ

- Related articles

What does it mean to backtest a portfolio?

Backtesting a portfolio means applying a set of rules to historical market data to simulate how a multi asset allocation would have performed in the past. You define your universe of assets, allocation method, rebalancing schedule, risk controls, and trading costs, then compute the equity curve and risk metrics.

Unlike a single instrument strategy backtest, a portfolio backtest examines allocation across assets. You might weight equally, by market cap, by risk contribution, by expected return and covariance, or by signals like momentum and value. The goal is to validate whether your construction and management rules deliver acceptable returns with tolerable risk and whether results are stable across different periods.

If you are new to the concept, you can read background material on backtesting essentials and the Sharpe ratio after reviewing the core ideas in this guide.

How to backtest a portfolio: the essential workflow

A good backtest starts with a clear question. Are you trying to reduce drawdowns, improve risk adjusted returns, diversify a concentrated exposure, or test a tactical overlay? Write that objective in one sentence, then proceed through these steps.

Define your universe and rules

Select assets that fit your objective, for example large cap equities, investment grade bonds, commodities, or crypto majors. Specify allocation logic such as equal weight, risk parity, minimum variance, or a factor tilt toward momentum, quality, or value. Decide whether to set hard risk limits, such as maximum position weights or volatility caps.

Choose your timeframe and frequency

Pick a start date that captures multiple market regimes. Tactical approaches may use daily or intraday data, while strategic ones can rely on monthly data to reduce noise. Set a rebalancing frequency consistent with your method and trading costs. To practice safely before going live, try a realistic trading simulator.

Model transaction costs and slippage

Include commissions, average bid ask spreads, and a slippage estimate to avoid overly optimistic results. Rising turnover can degrade performance, so costs must be realistic.

Include survivorship and delisting effects

If you test equity portfolios, use a dataset that includes dead stocks and point in time index membership to avoid survivorship bias.

Run the simulation and review metrics

Record performance, volatility, drawdowns, Sharpe and Sortino ratios, turnover, and stability across subperiods. Look for consistency, not just headline returns.

Split your data

Separate in sample and out of sample periods. Calibrate your method on one set, then test it on another to detect overfitting. Walk forward analysis and cross validation can help.

Refine carefully

Adjust parameters only when you have a hypothesis, not just to chase a higher Sharpe. Each change should be explainable in economic terms.

Metrics that matter when you backtest a portfolio

A single number rarely tells the full story. Evaluate several dimensions to understand both reward and risk quality.

Return and compounding

Review annualized return and the path of cumulative returns. The path matters because it affects investor experience and the odds of sticking with the plan.

Volatility and downside risk

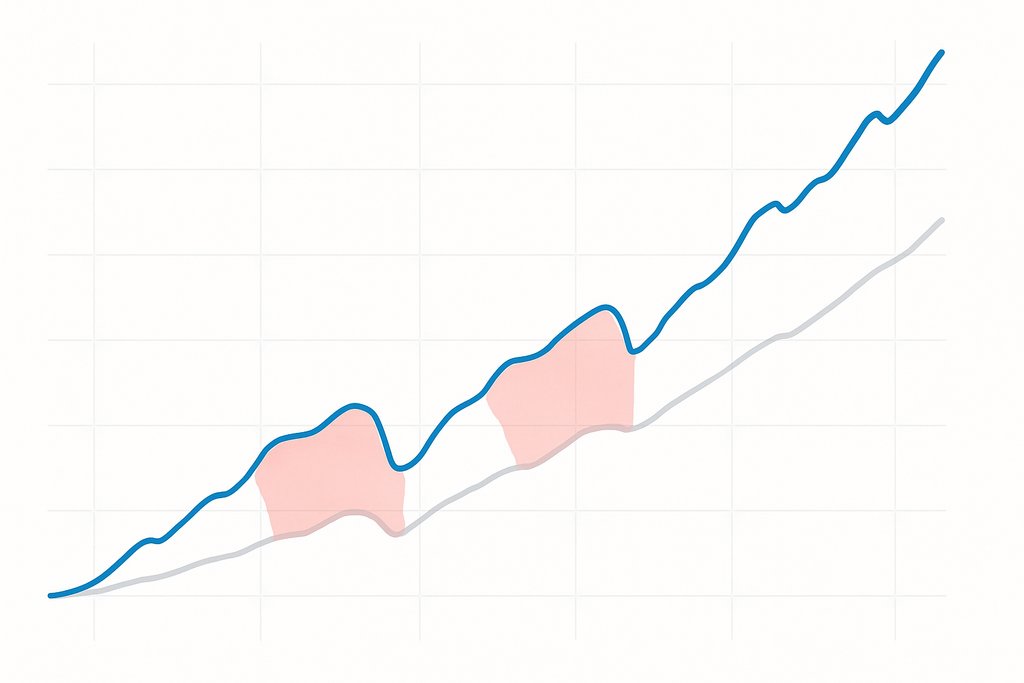

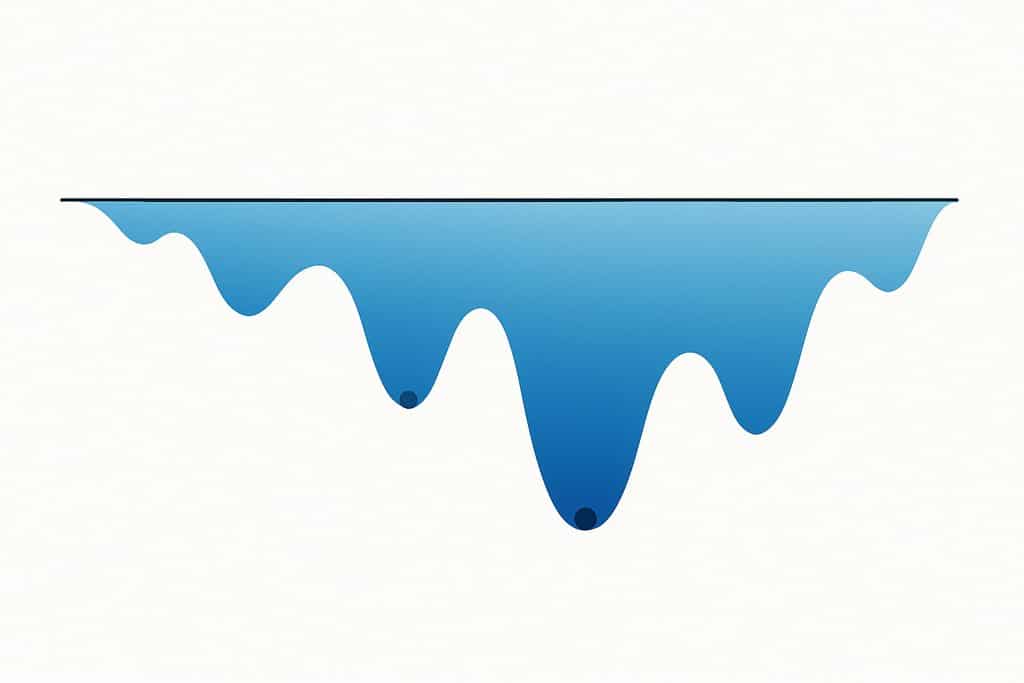

Annualized standard deviation is a starting point, but also measure maximum drawdown and time to recover. Downside measures like the Sortino ratio can be more informative when losses matter more than gains.

Risk adjusted performance

The Sharpe ratio compares excess return to volatility. Over long horizons, a stable Sharpe can indicate a durable edge, but be cautious with short samples. Consider the Calmar ratio for drawdown sensitivity.

Stability and robustness

Check performance across subperiods such as pre and post crisis, bull and bear markets, and low versus high volatility regimes. Robust portfolios should not collapse when conditions change.

Diversification and correlation

Examine correlations between assets and against your benchmark. If everything moves together, you may not be as diversified as you think. Beta relative to a broad index shows how much market risk you carry.

Turnover and implementability

High turnover often signals fragility and high cost. Ensure your rules do not require trading in illiquid moments or instruments. If you plan to automate, review your broker’s order types and latency, or explore trading automation options.

Avoiding common backtesting pitfalls

Even experienced teams can fall into traps. These issues can inflate apparent performance without you realizing it.

Look ahead bias

This occurs when your backtest uses information that was not available at the decision time, for example revised earnings or end of day prices for intraday rules. Align signals and execution with realistic lags.

Survivorship bias

If your equity universe excludes delisted or bankrupt companies, historical results will look too good. Use data that reflects the true investable universe at each point in time.

Overfitting and data snooping

Tuning parameters to maximize past performance often captures noise. Keep models simple, limit degrees of freedom, and validate on out of sample data. Walk forward analysis helps assess stability.

Ignoring costs and slippage

Results that exclude real world frictions are rarely achievable. Model spreads, commissions, and market impact that scale with turnover and liquidity.

Misaligned rebalance assumptions

Executing at exact open or close prices without slippage can misrepresent reality. Choose rules that reflect your broker, your size, and typical execution windows.

Regime blindness

A single period may hide sensitivity to regime shifts. Test across stress events and run scenario analyses to gauge resilience.

Portfolio backtesting methods: from simple to advanced

There is no single correct method. Choose an approach that matches your objective and data.

Static allocations

Equal weight, cap weight, 60/40, and target risk portfolios rebalanced on a fixed schedule. Simple rules can be robust if costs are low and you can tolerate drawdowns.

Risk based allocations

Risk parity and minimum variance aim for smoother risk distribution. They depend on covariance estimates, so use reasonable lookbacks and shrinkage.

Signal driven allocations

Factor tilts and tactical models adjust weights using signals like momentum, carry, valuation spreads, or macro indicators. They can help in trend dominated regimes but demand discipline to avoid churn.

Constraint aware optimization

Markowitz mean variance and Black Litterman frameworks encode views and constraints. They can overfit if inputs are noisy. Use regularization and robust covariance estimates.

Stress and scenario overlays

Rules that reduce risk during volatility spikes or after large drawdowns can improve ride quality. For example, cap equity weight when realized volatility exceeds a threshold.

A practical, step by step backtest of a diversified portfolio

Imagine evaluating three variations: a classic 60/40 stocks and bonds mix, a risk parity approach across the same assets, and a simple momentum tilt that increases stock weight when momentum is positive.

Start with data

Choose broad, liquid proxies such as a US equity index fund and a US aggregate bond fund. Pull monthly total return data for at least 15 years that include multiple cycles.

Define rules

For 60/40, rebalance monthly to target weights. For risk parity, compute trailing 6 month volatility and weight by inverse volatility with caps. For the momentum tilt, if the 12 month return on equities is positive, set equity to 70 percent and bonds to 30 percent, otherwise revert to 50/50.

Include costs

Apply a small commission per trade and a spread based slippage estimate. Track turnover and test sensitivity to higher costs. For deeper context, see our guide on algorithmic trading.

Run the backtest

Compute returns for each version, record volatility, Sharpe, maximum drawdown, and time under water. Compare the full sample and subperiods like 2008 to 2010, 2020 to 2021, and 2022.

Interpret cautiously

You might find that risk parity reduces drawdowns with similar returns, while the momentum tilt enhances returns in strong trends but adds turnover. Decide if the tradeoff aligns with your goals and behavior. If you prefer not to code, platforms like Obside let you describe rules in plain language and test them instantly.

How to backtest a portfolio with Obside, from idea to execution

Obside is a financial automation platform that turns plain language instructions into backtests, alerts, and live trading logic. You write what you want, like a message to a colleague, and Obside Copilot translates it into executable rules that you can test and run.

Describe your idea: Keep 50 percent in a broad equity ETF, 30 percent in a bond ETF, and 20 percent in gold. Rebalance monthly. If 6 month realized volatility on equities exceeds 25 percent, shift 10 percent from equities into cash. Include a 10 basis point trading cost and a 5 basis point slippage per trade.

Run an ultra fast backtest: Obside computes performance, drawdowns, Sharpe and Sortino ratios, turnover, and subperiod stats. You can switch timeframes, change signals, and preview sensitivity without manual coding.

Add alerts and protective rules: Set messages such as Alert me if 30 day volatility doubles or Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish. For portfolios, you might say Alert me if total drawdown exceeds 10 percent or if correlation between assets spikes above 0.8.

Automate execution: When satisfied, connect your broker or exchange and let Obside implement your rules. For example: Sell all my positions if the S&P 500 drops by 10 percent or Keep 50 percent in Bitcoin, 25 percent in Ethereum, and 25 percent in USDC, rebalancing weekly. You can also define tactical orders like Buy $1000 of Bitcoin if the price is below $100,000. Learn more about turning ideas into real orders in our guide to trading automation.

Paste one instruction and let Obside build, test, and automate:

- Keep 50 percent in Bitcoin, 25 percent in Ethereum, 25 percent in USDC. Rebalance weekly.

- Alert me if Bitcoin rises above $150,000 and daily volume doubles.

- Buy $50 worth of Tesla if Elon Musk tweets about it.

Want to explore more no code automation ideas? Check our guide on automated trading bots.

Backtest portfolio examples that investors use in practice

Long term core with defensive overlay. A global equity and bond core with a volatility based overlay can smooth the ride. The overlay reduces equity weight during volatility spikes, then redeploys when conditions normalize. Backtesting reveals whether drawdowns shrink without erasing returns.

Factor tilt across regions. A developed markets equity basket tilted toward quality and momentum can improve risk adjusted returns relative to cap weight. Backtest regionally neutral tilts versus a concentrated tilt to see how diversification and costs interact.

Crypto momentum rotation. Rotating among Bitcoin, Ethereum, and stablecoins based on trend strength can help sidestep deep drawdowns. Include realistic spreads and slippage, and stress high volatility periods. With Obside, you can express the logic in one sentence and update allocations automatically. For crypto, see our guide to an AI crypto trading bot.

Commodity shock hedges. Adding a small commodity sleeve or energy exposure as a hedge against inflation shocks changes drawdown behavior. Backtesting estimates the tradeoff between carry drag in normal times and protection in stress episodes.

Benefits of portfolio backtesting and key considerations

A backtest improves decision quality by grounding choices in evidence. It clarifies expectations, calibrates risk tolerance, and helps you avoid strategies that only work under perfect conditions. It also fosters discipline, since you can predefine responses to volatility spikes, drawdowns, or macro events.

There are important caveats. Past performance is not a guarantee of future results. Markets change, relationships shift, and liquidity can dry up when you need it most. Backtests simplify reality, so aim for robustness over precision. Favor clear, explainable rules. Seek stability across regimes. Include costs and slippage. Test stress scenarios, then keep monitoring in live trading.

Key benefits at a glance

- Evidence based decisions, not guesses

- Clear expectations for returns and risk

- Early detection of fragility and overfitting

- Discipline through predefined rules

Actionable next steps

Write your objective in one sentence. Decide whether you want higher return, lower drawdown, or a smoother ride, and how you will measure success.

Choose assets and rules that match your objective. Keep it simple at first, then add nuance as needed. Define rebalancing, risk caps, and costs.

Run an honest backtest. Split in sample and out of sample. Look at both performance and stability. Be skeptical of big improvements from small tweaks. For newcomers, start with our beginner’s trading guide.

Translate into action. Use alerts for risk limits, predefine execution rules, and automate routine rebalancing to reduce human error. If you want to go from idea to execution in minutes, describe your portfolio to Obside Copilot, backtest it, and deploy when you are ready.

References for deeper reading

FAQ: Backtest portfolio

How much history do I need to backtest a portfolio?

Aim for at least one full market cycle that includes a bull market, a bear market, and a recovery. For strategic allocations, 10 to 20 years of monthly data is helpful. For tactical methods, daily or intraday data can be useful, but be careful with noise and execution assumptions.

What rebalancing frequency works best?

There is no universal answer. Monthly rebalancing is a common compromise between tracking targets and limiting costs. Quarterly can work for slower moving rules. Faster strategies may require weekly or daily updates, but costs can erode benefits. Test several frequencies and include realistic transaction costs.

How do I add transaction costs and slippage to a backtest?

Estimate commissions per trade, typical bid ask spreads, and slippage as a fraction of the spread or price. Apply these costs each time your rules trade. Sensitivity tests that double costs can reveal how fragile your results are.

Is a high Sharpe ratio enough to trust a portfolio?

Not on its own. Look for stability across subperiods, reasonable turnover, manageable drawdowns, and an economic rationale. A slightly lower Sharpe with better robustness and lower complexity is often preferable.

What is the difference between strategy backtesting and portfolio backtesting?

Strategy backtesting usually tests entry and exit rules for a single instrument or a small set. Portfolio backtesting focuses on allocation across many assets, rebalancing, and risk control at the portfolio level. Both matter, and they can be combined if your portfolio uses signal driven sleeves. To go deeper, see our overview of algorithmic trading.

Related articles

- Best Automated Trading Platform: Top Picks for 2025

- Best Trading Bot: Choose, Test, and Automate Your Edge

- How to Start Trading: A Practical Beginner’s Guide

- Trading for Beginners: Simple Steps to Your First Trades

- Best Trading App: Pick the Right Platform for You in 2025

- Trading Simulator: Practice, Test, and Improve Strategy