Trading Bot Software: How to Choose, Build & Run Bots

Learn how trading bot software turns your rules into automated market actions, from signals and risk controls to backtesting and live execution.

Table of contents

- What is trading bot software?

- Core components of modern trading bots

- How to evaluate trading bot software

- Building and deploying a bot with Obside

- Practical examples

- Benefits and considerations

- Conclusion and next steps

- FAQ

What is trading bot software?

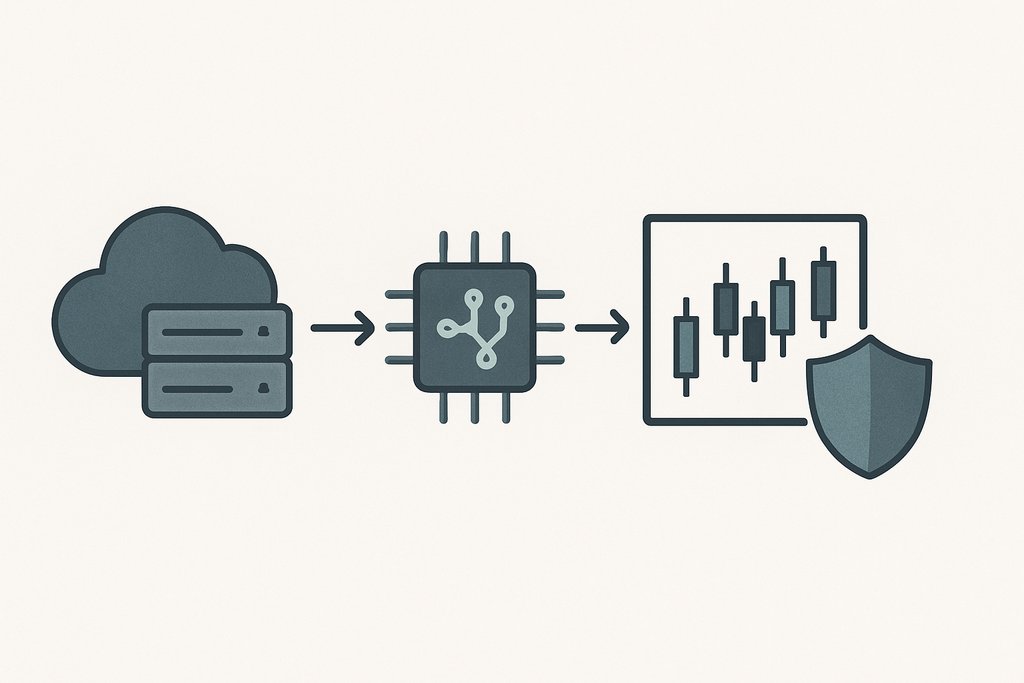

Trading bot software is a system that automates the process of analyzing markets and executing orders based on predefined logic. It is algorithmic trading applied to your rules whether they rely on technical indicators, price patterns, fundamental news, or macroeconomic data. Institutional principles apply at smaller scales for individual traders and teams.

In practice, a trading bot can watch for signals such as moving average crossovers or Relative Strength Index thresholds. It can react to external events like earnings announcements or policy headlines and enforce discipline by managing stops, targets, and position sizes automatically.

For a broader overview of the field, see algorithmic trading on Wikipedia. If you want a deeper dive into the indicator itself, review our guide to the RSI indicator.

Core components of modern trading bot software

Strong trading automation rests on a few components that work together: signals and data ingestion, strategy logic, risk management and execution, backtesting and validation, and monitoring. Understanding each piece helps you evaluate platforms and build bots that survive contact with real markets.

Signals and data ingestion

Your bot needs clean, timely data to fuel its logic. That includes prices, volumes, order book snapshots, and indicators. If your strategy is technical, your signals might draw on indicators such as RSI and MACD. For accessible explanations, see RSI on Investopedia. Event-driven strategies require reliable news feeds and sentiment inputs, which you can explore further in our Trading News Hub.

Platforms like Obside make signal definition straightforward. Describe in plain language what you want to watch and let Obside Copilot translate that into live monitoring. Examples include “Alert me if Bitcoin rises above 150,000 dollars and daily volume doubles” or “Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish.”

Strategy logic and rules

Once you have signals, you codify actions: enter, exit, scale, rebalance, or alert. Good trading bot software lets you express logic clearly and test it quickly. That can be as simple as buying a fixed amount when price dips below a threshold, or as nuanced as multi time frame logic that checks trend alignment before acting.

With Obside, you can write complex strategies conversationally. For instance, “When the Supertrend becomes bullish on the 2 hour chart, if RSI is not overbought and the Supertrend on the 8 hour chart is also bullish, then buy. For selling, reverse the logic. Add a trailing stop loss at 5 ATR on the 2 hour chart and close the position if the Supertrend on the 2 hour chart changes direction.” To go deeper into building end to end systems, read Algorithmic Trading: Build, Test & Automate.

Risk management and execution

Risk is where many strategies fail. Your bot should support position sizing, stop loss and take profit rules, trailing stops, and kill switches. It should include protections for slippage, gap risk, and connectivity failures. Execution quality matters as much as signal quality, which is why low latency order routing, robust broker integrations, and retry logic are essential features.

Obside connects to brokers and exchanges so your rules drive real orders once validated. From simple actions like “Buy 1,000 dollars of Bitcoin if the price is below 100,000 dollars” to portfolio level safeguards such as “Sell all my positions if the S&P 500 drops by 10 percent,” execution aligns with your plan, not your mood. Learn more in our guide on Trading Automation.

Backtesting and validation

Before you go live, backtest your strategy on historical data to check behavior across regimes. Backtesting helps you estimate drawdowns, win rates, and performance metrics. For an overview of concepts, see backtesting on Investopedia.

Obside’s ultra fast backtesting engine validates logic in seconds so you can refine and deploy without long delays. If you want to compare tools and approaches, read Backtesting Software: How to Pick, Use, and Trust It.

Monitoring and control

Even the best bot needs observation. You want real time logs, alerts when rules trigger, and clear dashboards for positions, PnL, and exposure. If something deviates from expected behavior, you should be able to pause or adjust safely.

Obside provides dashboards that make live control and post trade review straightforward, so you can respond promptly and learn continuously.

How to evaluate trading bot software

Evaluating platforms goes beyond feature lists. Think about how each solution fits your workflow from idea to execution.

First, assess ease of strategy creation. If you do not code, you need a system that translates plain language into rules accurately. Obside Copilot specializes in this. If you do code, confirm that the platform exposes enough flexibility for advanced logic and custom indicators.

Second, stress test data quality and latency. Your signals only work if the data is correct and timely. For event driven strategies, check the depth of news coverage and speed of updates. For technical strategies, confirm that indicators are computed consistently across time frames.

Third, inspect backtesting fidelity. Does the platform handle realistic assumptions about slippage, fees, and order types? Does it allow different execution simulation modes, such as limit orders versus market orders?

Fourth, verify broker and exchange integrations. You need reliable connections for the markets you trade, whether crypto, equities, or forex. Connectivity and order routing should be robust with clear error handling in case of outages.

Fifth, plan for monitoring and override. You want to see what the bot is doing and be able to stop or modify behavior quickly. This includes audit trails for triggered conditions and executed orders.

Lastly, consider support and community. Obside won the Innovation Prize 2024 at the Paris Trading Expo and is supported by Microsoft for Startups, which speaks to reliability and ambition.

Building and deploying a bot with Obside

If your goal is to go from idea to automation with minimal friction, Obside offers a streamlined path. You can start in minutes and progress from alerts to live execution as your confidence grows.

Create your account at Obside Beta. Once inside, chat with Obside Copilot and describe your intent in plain language. For example, “Alert me if Apple announces a new product,” or “Tell me when OpenAI announces a new AI model.” Copilot will propose data sources, conditions, and alert channels. If you want actions, add them. You could say, “Buy 50 dollars worth of Tesla if Elon Musk tweets about it,” and the system will wire that logic to your connected broker.

Next, backtest where it makes sense. If your strategy is technical, validate quickly with historical charts and engine outputs. If it is event driven, simulate logic with historical events and tune rules for precision and noise reduction.

After validation, connect your broker or exchange and choose between paper trading or live execution. Start in paper mode to confirm real time behavior. Add safety rails like stop losses and maximum daily drawdown limits. Monitor your first days of execution closely.

Finally, review performance and iterate. Adjust parameters, add filtering logic, and refine risk rules. As strategies mature, automate portfolio level tasks such as rebalancing and hedging.

Practical examples: from alerts to portfolio automation

Automation spans a spectrum of complexity. Alerts are the lightest form. They catch opportunities and let you decide. For example, “Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish.” The combination of an overbought signal with momentum reversal can mark a turning point. The alert saves you from scanning charts all day.

Action rules remove friction between decision and execution. “Buy 1,000 dollars of Bitcoin if the price is below 100,000 dollars” enforces discipline on dips. A safety rule such as “Sell all my positions if the S&P 500 drops by 10 percent” acts as a circuit breaker for your portfolio.

Detect a bullish RSI divergence on a 15 minute chart, set a stop at the low of the day, and target a 10 percent take profit. For step by step guidance, see Best Trading Bot: Choose, Test, and Automate Your Edge.

Portfolio rules abstract trading to allocation. You might set “Keep 50 percent in Bitcoin, 25 percent in Ethereum, and 25 percent in USDC,” then rebalance weekly or when volatility spikes. When macro conditions change, Obside can react in real time so you adjust exposure promptly.

Benefits and considerations of trading bot software

Automation offers tangible benefits. The first is consistency: rules are executed exactly as written, which reduces the influence of emotions. The second is speed: the bot can act instantly across many instruments. The third is coverage: you can watch multiple markets and time frames simultaneously. The fourth is validation: backtesting and paper trading help you assess strategies before risking capital. The fifth is scalability: once a strategy works, you can deploy it across instruments or accounts without multiplying workload.

- Consistent rule execution

- Faster decisions across markets

- Scalable deployment

There are important considerations. Overfitting to past data can fail in live markets. Combat it by keeping rules simple, testing across regimes, and using out of sample validation. Data quality and latency can make or break signals, especially in fast markets. Slippage and fees change live results versus backtests, so incorporate realistic assumptions. Black swan events will occur, so you need kill switches and position limits. Monitoring is not optional.

Conclusion and next steps

Trading bot software is the bridge between strategy and execution. If you have rules you trust, automation turns those rules into market actions consistently and at speed. Start by defining a simple alert that fits your style, validate it, then add action rules with tight risk controls. As you gain confidence, progress to full strategies and portfolio automation.

If you want to go from idea to market in seconds, try building your first bot with Obside Copilot. Backtest with the ultra fast engine, connect your broker or exchange, and run in paper mode before going live. Recognition such as the Innovation Prize 2024 at the Paris Trading Expo and support from Microsoft for Startups make Obside a trusted path to practical automation. This article is educational and not financial advice. Trading involves risk, and past performance does not guarantee future results.

FAQ

What is trading bot software and how does it differ from manual trading?

Trading bot software automates your rules for analyzing markets and executing orders. It watches data and events continuously, then acts based on predefined conditions. Manual trading depends on your attention and discipline in the moment, while bots increase consistency and speed and allow broader market coverage. For background, see algorithmic trading on Wikipedia.

Do I need to know how to code to use trading bot software?

Not necessarily. Platforms like Obside let you describe strategies in plain language. Obside Copilot turns your instructions into executable alerts, actions, and full strategies. If you do code, you will still benefit from fast backtesting and streamlined execution.

Which markets can trading bot software handle?

Most platforms support multiple asset classes such as crypto, equities, and forex. Obside connects to brokers and exchanges so you can automate across markets with consistent logic. Signals range from technical indicators like RSI and MACD to event driven triggers tied to news and macro data. For indicator details, see our RSI guide.

How should I validate a strategy before going live?

Backtest on historical data to understand behavior under different regimes, then paper trade to observe live execution and slippage. Incorporate realistic assumptions about fees and order types. A primer is available at Investopedia’s backtesting guide. Obside’s engine speeds the process so you can iterate rapidly, and our backtesting software guide helps you choose the right tool.

What are common mistakes when starting with trading bot software?

Common mistakes include overfitting to historical data, ignoring slippage and fees, setting stops too tight for the instrument’s volatility, and going live without paper tests. Start simple, add risk controls early, and monitor closely. Use kill switches and exposure limits to protect capital while you learn.