Best Day Trading Platform: Speed, Orders, Automation

Learn how to choose the best day trading platform for fast execution, smart order types, reliable data, and built-in automation. See where Obside helps you move from idea to execution in seconds.

Why your platform choice matters

Choosing the best day trading platform is one of the most consequential decisions an active trader makes. When you enter and exit positions within minutes or hours, your platform is not just a tool, it is the engine that powers your edge. Poor execution speed, limited order types, unreliable data, or the inability to automate routine tasks can turn a promising system into a frustrating grind.

This guide breaks down what a day trading platform must deliver, how to evaluate options hands-on, and where automation-first tools like Obside fit in for traders who want to go from idea to execution in seconds.

Table of contents

- What is a day trading platform

- What makes the best platform

- Execution speed and reliability

- Order types and risk controls

- Charting, indicators, and multi-timeframe views

- Data quality, Level II, and coverage

- Costs, commissions, and hidden frictions

- Automation, alerts, and real-time actions

- Backtesting, paper trading, and iteration speed

- Mobile, desktop, and multi device continuity

- Support, stability, and community

- Types of day trading platforms

- A one week plan to test

- Where Obside fits

- Benefits and considerations

- Conclusion and next steps

- FAQs

- Related articles

What is a day trading platform

At its core, a day trading platform is software that lets you analyze markets, place and manage orders, and control risk in real time. Unlike long-term investing suites, day trading software prioritizes speed, precision, and workflow efficiency. The best day trading platform brings together a few essentials:

- Fast, stable order entry that minimizes delays and misclicks

- Robust charting with the indicators and drawing tools you use

- Depth-of-market or Level II for liquid markets when needed

- Smart order types and bracket logic for automatic risk control

- Reliable, granular data with minimal lag

- Mobile and desktop clients with synchronized sessions

- Automation and alerting to act on conditions without manual input

- Safe testing through backtesting and paper trading

If you are new to day trading, this overview is a helpful starting point: what day trading means and how it differs from other styles.

What makes the best platform for day trading

The right platform depends on your style. A fast scalper will not choose the same toolset as a news-driven trader. Evaluate the capabilities below against your workflow, then test in live conditions.

Execution speed and reliability

When your holding period is measured in minutes, seconds matter. Examine order acknowledgment time, platform stability at the open, and behavior during news spikes. Slippage, the difference between expected and actual execution price, can erode profitability if your platform lags. Reliable platforms provide clear feedback on order status and partial fills, and support hotkeys or one-click tickets for repeat actions.

Order types and risk controls

Advanced order types help you manage trades even when you cannot watch every tick. Look for native support for bracket orders with synchronized stop loss and take profit, trailing stops, OCO and OCA logic, time-in-force options, and hidden or iceberg orders where available. The best day trading platform lets you predefine position sizing rules and risk per trade by instrument so your behavior is consistent.

Charting, indicators, and multi-timeframe views

Strong charting is more than a colorful interface. You want flexible layouts across multiple monitors, and the ability to switch timeframes without losing drawings or custom indicators. If momentum or mean reversion drives your method, you will likely rely on tools such as RSI and practical RSI settings. For a broader foundation, see Technical Analysis: read markets like a pro. For order flow heavy approaches, DOM and footprint charts can be decisive. Event-driven traders benefit from an integrated news feed and economic calendar.

Data quality, Level II, and market coverage

A platform lives and dies with its data. If you trade US equities, ensure you have consolidated quotes and, ideally, Level II market depth. For forex or crypto, verify that tick data is robust and that latency is low with your broker or exchange. Multi-asset traders should confirm that a single workspace can handle stocks, futures, forex, and crypto without awkward switching.

Costs, commissions, and hidden frictions

The headline commission is only part of your total cost. Evaluate direct and indirect factors that affect fills and outcomes:

- Commissions and exchange fees

- Data packages and add-ons for premium feeds or Level II

- Borrow fees if you short frequently

- Routing charges and rebates with direct market access

- Slippage and spread, which can dwarf commissions

Platforms that help you simulate total cost, or export fills to compute net impact, make decisions clearer. Zero commission is not always cheaper if spreads widen or execution quality drops.

Automation, alerts, and real-time actions

Even discretionary traders benefit from automation. Precise alerts, conditional orders, and rule-based reallocations reduce errors and decision fatigue. This is where modern platforms like Obside stand out. You describe what you want in plain language, validate logic with backtesting, then connect brokers and exchanges to act in real time. Learn more about trading automation from idea to execution.

“Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish” becomes a live alert or an automated bracket in Obside. You describe it, test it, and deploy.

Practical examples you can run:

- Alert me if Bitcoin rises above $150,000 and daily volume doubles

- Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish

- Buy $50 of Tesla if Elon Musk tweets about it

- Sell all positions if the S&P 500 drops by 10 percent

Backtesting, paper trading, and iteration speed

You need a safe sandbox to test changes to your approach. Backtesting shows how a rule would have performed on historical data, while paper trading helps you test execution flow without risking capital. The key is speed. If it takes hours to test an idea, you will test fewer ideas. Obside’s engine validates strategies in seconds, so experimentation becomes a daily habit.

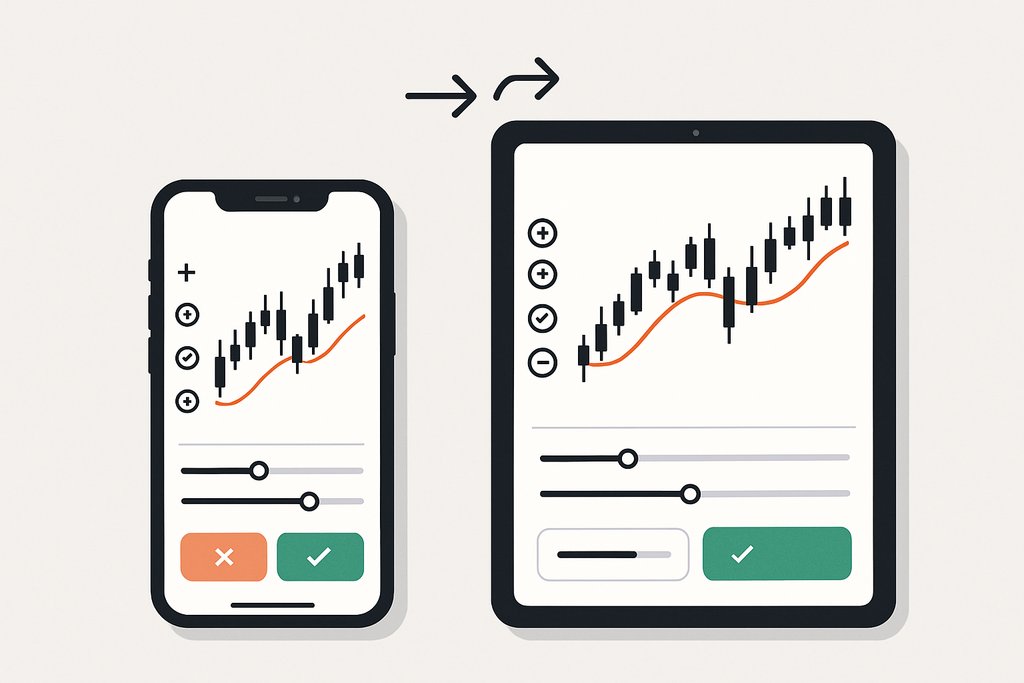

Mobile, desktop, and multi device continuity

Traders increasingly manage positions from anywhere. A good platform keeps your workspace synchronized, pushes meaningful alerts to your phone, and provides enough mobile functionality to close or hedge quickly. For heavy charting or tape reading, a multi monitor desktop setup still tends to be superior.

Support, stability, and community

When routers fail or APIs change, responsive support and clear status pages matter. A strong community or marketplace of strategies accelerates learning and validation. Obside won the Innovation Prize 2024 at the Paris Trading Expo and is supported by Microsoft for Startups, two signals that professionals value the approach.

Types of day trading platforms and how they fit

There is no one size fits all. Think in categories, then choose based on your style.

Broker native platforms are provided by the broker and offer tight integration with routing and account management. They are convenient for execution and capital efficiency, and for equities with direct market access they can minimize friction from click to fill.

Standalone charting and execution suites focus on visualization, indicators, and scripting. They excel at multi timeframe layouts and building custom studies, which many discretionary traders prefer.

Automation first platforms like Obside convert plain language rules into alerts, orders, and portfolios. They shine when your edge comes from reacting fast across markets or when you want consistent, rule-based execution.

Hybrid workflows are common. Many traders use a broker platform for routing, a charting suite for visualization, and an automation layer to trigger rules. The best day trading platform might be the combination that removes your biggest bottleneck.

A one week plan to test the best platform for you

Day 1: Define your style and must haves

Are you scalping futures, trading momentum breakouts in large caps, or reacting to macro news in FX and crypto. List must haves like Level II, hotkeys, or a news trigger system. If automation matters, add Obside to your shortlist at obside.com and try the chat-based Copilot.

Day 2: Replicate your chart setup

Import or recreate watchlists, indicators, and layouts. Confirm you can switch timeframes without losing drawings and that multi monitor layouts stay responsive.

Day 3: Measure execution flow

Place small test orders in calm and busy periods. Track order acknowledgment time, partial fills, and cancel replace behavior. If you rely on brackets, verify stops and targets populate instantly at entry.

Day 4: Automate one repetitive task

In Obside, try a rule like “Buy $1,000 of Bitcoin if the price is below $100,000” or “Alert me if Apple announces a new product.” Validate with backtesting, then paper trade it live.

Day 5: Stress test data and stability

Open the platform at the market open or during a major release. Confirm that charts update smoothly and that the platform remains stable. Test multi-asset workspaces if you trade across markets.

Day 6: Review costs and reporting

Export fills and estimate slippage. If a PnL analytics module exists, assess win rate, average win and loss, and drawdown. Ensure fees and data packages are clear.

Day 7: Decide and deploy

If the platform boosts clarity and speed, start live with small size and scale as your comfort grows. If not, iterate and repeat the test cycle.

Where Obside fits in the best day trading platform conversation

Obside is a financial automation SaaS that turns your ideas into market actions. You chat with Obside Copilot, describe your rule in plain language, validate it with ultra fast backtesting, then run it automatically with connected brokers and exchanges at beta.obside.com. Because it can listen to prices, technical indicators, news, and macroeconomic data, Obside is a natural fit for day traders who need speed with discipline.

Consider these practical use cases:

- Technical triggers become actions: describe your RSI and MACD rule, test, then let it alert or place a defined order.

- Event driven trades stop being manual: “Sell your stocks if new tariffs are announced” or “Buy oil when a hurricane hits.”

- Full strategies run consistently: define entries, stops, targets, and trailing logic, then backtest and deploy.

Speed matters. Obside’s backtesting engine is built for seconds, not hours, so you can refine rules between the open and lunch and deploy adjustments the same day. Credibility matters too, with industry recognition and support that signals professional trust.

Benefits and considerations when choosing a platform

- Faster, more reliable execution

- Consistent risk control with smart orders

- Less decision fatigue with automation

The benefits of a strong platform show up as confidence, clarity, and fewer errors. Smart order types enforce discipline when emotions run hot. Automation and alerts reduce workload so you can focus on reading the market instead of clicking buttons. Good data and charting keep you aligned with your strategy.

There are considerations. Complexity can lead to misconfiguration, so start simple and add features gradually. Over automation can make a flexible discretionary approach rigid if you automate the wrong elements. Costs can add up through data packages and extras, so run the numbers. Align features with your style and remove bottlenecks first.

Conclusion: next steps to find your best day trading platform

Finding the best day trading platform is a process. Define your style, list must have features, and test under real conditions. Prioritize execution reliability, risk controls, and the ability to automate daily tasks. If event-driven or rules-based trading is part of your edge, try an automation-first tool like Obside to bridge the gap between idea and execution.

Shortlist two platforms that fit your style and one automation layer such as Obside. Recreate your setup, paper trade for a few sessions, and measure execution quality and decision fatigue. Then go live with small size and scale as confidence builds.

Expert tip from Benjamin Sultan: The platform you choose should make you faster at your own best trades. If a feature does not directly improve your entries, exits, or risk, it is probably a distraction.

Deepen your foundation with focused reading. If you want to master chart context and indicators, start with RSI and core technical analysis. When you are ready to automate, learn how to structure rules that translate directly into alerts and orders.

Explore more on indicators and chart reading in the Technical Analysis guide, and see how to go from intent to action with Trading Automation.

FAQs about the best day trading platform

What is the best day trading platform for scalping?

Scalpers need fast execution, hotkeys, and stable data during high volume moments. Broker native platforms with direct market access are often preferred for equities, while futures scalpers prioritize robust DOM and one click brackets. If your scalping relies on technical or event triggers, using Obside to automate alerts and bracket placement can free attention for tape reading while still acting instantly.

Do I need Level II quotes to day trade effectively?

Level II or depth of market can help if your strategy depends on order book dynamics or liquidity analysis. Momentum and breakout traders often use it to gauge interest near key levels. If you rely more on higher timeframe signals or macro news, Level II may be helpful but not essential. For background, see this explanation of Level II.

How important is backtesting for day traders?

Backtesting is useful for rules-based components such as timing filters or exit logic. It is less about predicting the future and more about eliminating weak ideas and building confidence. Tools like Obside make backtesting fast, so you can iterate without losing trading time.

Can I manage day trades from my phone?

Yes. Many platforms offer mobile apps that let you monitor positions, receive alerts, and adjust orders. For heavy analysis, a desktop remains superior. A practical setup is desktop for charting and execution with mobile for alerts and emergency management. Obside can push alerts and actions in real time so you can react quickly when away from your desk.

Are commission free platforms always cheaper for day trading?

Not necessarily. Consider spreads, execution quality, how routing impacts fills, and exchange fees. For some strategies, improved fills on a commission-based route can be cheaper overall. Always analyze total cost, including slippage, not just the headline commission.

How can I safely add automation to discretionary day trading?

Start with alerts and risk controls. Automate your stop loss, take profit, and trailing logic, and let alerts prompt entries. As confidence grows, automate clear if-then rules you already follow manually. Obside is designed for this stepwise approach, since you can describe rules in plain language, backtest quickly, and run them live with your broker connection.