Buy and Sell Trading: A Practical, Proven Guide to Rules

Master buy and sell trading with a clear framework for timing entries and exits. Turn signals into rules you can test and automate in minutes with Obside.

If you searched for buy and sell trading, you probably want a clear way to decide when to enter and exit positions, and a framework to execute those decisions without hesitation. The challenge is rarely spotting a chart pattern or reading a headline. The real challenge is translating that insight into consistent buy and sell rules that you can test, refine, and run in real time. This guide gives you a focused, expert-level walkthrough that turns the idea of buy and sell trading into a repeatable process, with concrete examples you can put to work immediately.

What Is Buy and Sell Trading, Exactly?

Buy and sell trading is the practice of defining precise entry and exit rules, then executing them consistently in the market. It goes beyond the vague notion of buy low and sell high. Instead, it formalizes how you detect an opportunity, how you size the trade, where you place your stop and target, and how you manage the position until exit.

You can apply buy and sell trading across any asset class and timeframe. Day traders execute multiple buys and sells in minutes or hours. Swing traders hold for days or weeks. Investors may hold for months, yet still rely on disciplined buy and sell rules to avoid emotional decisions. The rules themselves can be technical indicator based, price action based, event or news driven, or hybrid. Once you define your rules, you can run them manually or automate them so that alerts and orders trigger instantly. If you need a primer on styles, explore our overview of types of trading strategies.

Obside is built around that concept. You describe your rules in plain language to the Obside Copilot, backtest them in seconds, then set alerts and actions that execute your buy and sell logic automatically with your connected brokers and exchanges.

The Building Blocks of Buy and Sell Signals

Choose your market and timeframe

Your buy and sell trading framework starts with scope. For crypto, high volatility can favor trend or breakout rules on intraday charts. For large cap equities, earnings dates and news may dominate swings. For FX, session timing and macro events can drive moves. The timeframe should match your availability, risk tolerance, and holding period. Short timeframes demand more monitoring and quicker execution. Higher timeframes reduce noise but require wider stops and patience. If you are new to currencies, see our Forex trading guide.

Define your signal type

There are several families of buy and sell signals. You can mix and match, but you should know what each one tries to capture.

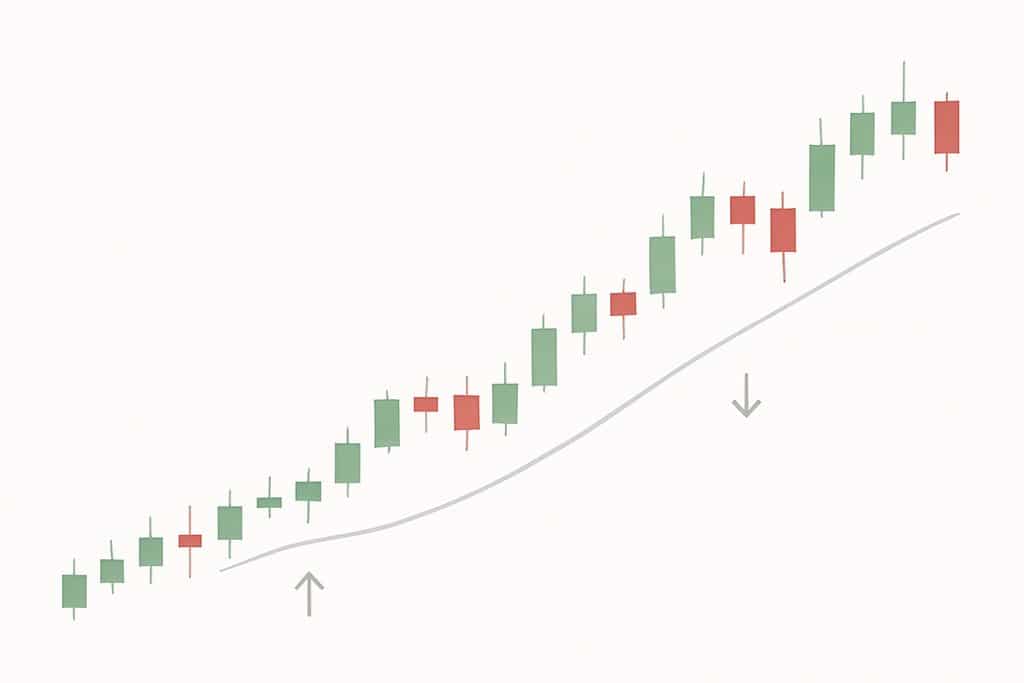

- Trend following: Buy strength and sell weakness. For example, buy when price breaks above a key moving average with momentum, sell when that condition reverses. Trend followers accept small whipsaws for the chance to ride large moves.

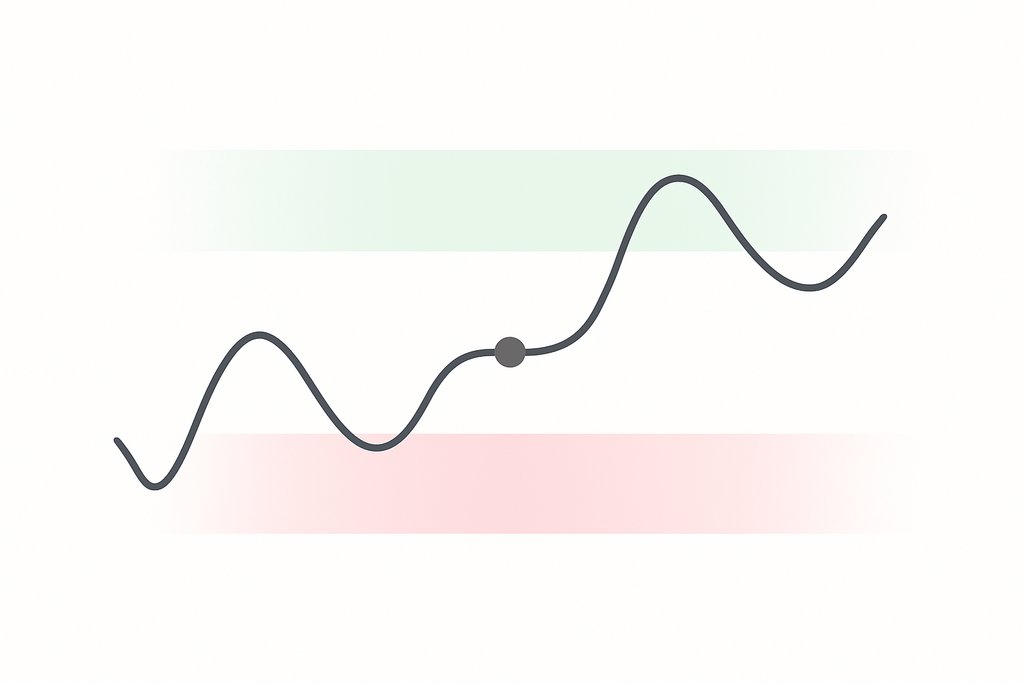

- Mean reversion: Fade short term extremes back toward an average. For example, in an established range, buy when price is oversold and returns above a threshold on the Relative Strength Index, then sell when it normalizes. It works best in sideways markets that rotate.

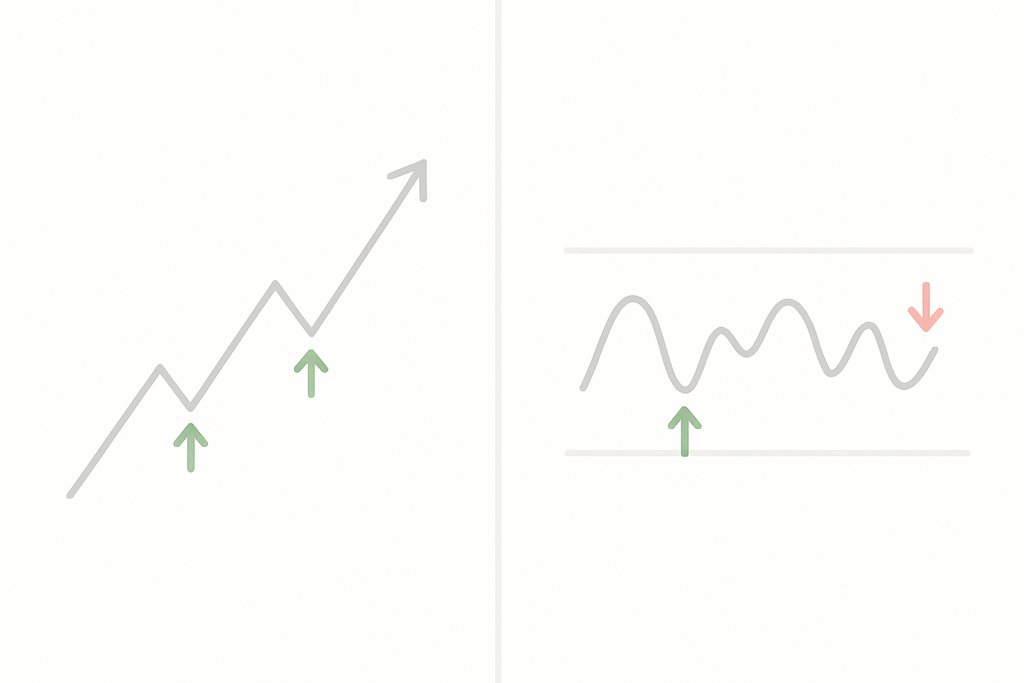

- Breakout and breakdown: Trade expansions from consolidation. Buy when price breaks out of a well defined range on rising volume, sell when the breakout fails or hits a target.

- Event driven: React to discrete catalysts. Buy or sell based on earnings, product launches, macro releases, or even social signals.

If you need a refresher on popular indicators used in buy and sell trading, see Investopedia’s article on the Relative Strength Index.

Plan risk and trade management

A buy signal is only half of buy and sell trading. You also need explicit exit rules, because exits determine how your edge plays out over many trades. Well defined exit logic can include a stop loss based on structure or volatility, a take profit at a multiple of risk, a trailing stop that locks in gains as price moves, and a time stop if nothing happens after a set number of bars.

Position sizing is your shock absorber. You can size by fixed amount per trade, fixed fractional risk, or ATR based volatility sizing. Many traders use the Average True Range as a volatility proxy to set stops and sizes that adapt to market conditions.

Choose execution and order types

Even a great buy and sell signal can lose edge at the execution layer. Decide whether you will use market, limit, or stop orders, and whether you will bracket trades with OCO logic. In liquid markets, limit orders can reduce slippage, but for fast moves a market order ensures you get filled. Your rules should also handle partial fills, price gaps, and volatility spikes.

If you plan to automate, decide which conditions should create alerts and which should place live orders. With Obside, you can do both. You can trigger an automatic buy when your signals confirm, or ask for an alert to review before the trade is placed. You can even add news or macro conditions to your signal, such as never buy if an earnings report is due within 24 hours.

How to Design a Buy and Sell Trading Strategy Step by Step

- Clarify your objective and constraints. What is your target holding period, typical risk per trade, and acceptable drawdown? A day trader seeking frequent trades will design differently from a swing trader who takes a few high quality setups per month.

- Pick your market and timeframe. Focus on a small set of symbols that fit your edge and schedule. Start with one timeframe to reduce complexity.

- Specify entry criteria. Choose a core logic that matches your market regime. For trend trading, consider moving average crosses with a momentum filter. For mean reversion, use an RSI threshold within a defined range.

- Specify exit rules. Decide a stop mechanism, profit taking, trailing rules, and a time stop. Write these as explicit conditions. For example, stop loss below the session low, take profit at 2 times risk, trail by 3 times ATR once the trade is in profit.

- Define position sizing. Select a rule that keeps your per trade risk consistent. Fixed fractional risk per trade, such as 0.5 percent to 1 percent of account equity, is a common choice.

- Backtest, refine, forward test, and automate. Backtesting helps you evaluate expectancy, drawdowns, and robustness. See our guide on building a trading strategy you can automate. Forward testing on a small size validates execution in live conditions. Practice safely with our paper trading guide, then automate alerts and orders.

For a faster path from idea to execution, you can describe these steps in plain language to Obside Copilot. For example: When 20 EMA crosses above 50 EMA on the 1 hour chart of BTCUSD, and RSI is below 60, buy. Place a stop at 2 times ATR, a take profit at 3 times ATR, then trail by 1.5 times ATR after price moves 1 ATR in favor. Close if 20 EMA crosses below 50 EMA. Copilot will translate this into a rule, backtest it in seconds, and set it to run with your broker.

If you prefer event driven logic, you might say: Buy USO if the National Hurricane Center issues a hurricane warning for the Gulf of Mexico and WTI is above its 200 day moving average, with a stop at yesterday’s low and a 2 times risk target. Or for equities: Sell 50 percent of my AAPL position if the company delays a product launch, and exit fully if the daily close falls below the 100 day moving average.

For more on backtesting, see Investopedia’s overview of backtesting, and for volatility sizing, see Average True Range.

Only trade in the direction of the higher timeframe trend. Enter on a pullback plus confirmation. Place stop beyond structure, take partials at 1.5R, trail the rest. Document and test variations in a strategy workspace.

Practical Buy and Sell Trading Examples You Can Run Today

Trend crossover with momentum

In a trending market, require alignment before you buy. For example, on EURUSD 1 hour, buy when the 50 period EMA is above the 200 period EMA and price breaks above the recent swing high with above average volume. Exit if the 50 EMA crosses back below the 200 or if a trailing stop of 3 times ATR is hit. This combines trend confirmation with a breakout trigger, which reduces false signals during choppy periods.

Mean reversion pullback in trend

On a stock index, first filter for uptrend using a 200 day moving average. Then buy when RSI pulls back below 40 and recovers above 45 while price remains above the 50 day average. Place a stop under the recent swing low and take partial profits at 1.5 times risk. Let a trailing stop capture extended moves. This approach buys dips in strong trends rather than chasing breakouts.

Range breakout

Identify a two week consolidation box on BTCUSD where daily highs and lows have compressed. Buy on a daily close above the range with a stop inside the box and a target at a measured move, for example the height of the range added to the breakout level. If the breakout fails back into the range, exit quickly to preserve capital.

Event driven rule

For Apple, buy a swing trade if a new product is announced and the stock gaps up on above average volume, provided the broader market is above its 50 day moving average. Exit the position if the gap fills and the stock closes below the open. This blends a catalyst with price confirmation and a clear invalidation.

Obside makes all four examples straightforward. You can set smart alerts that combine price, indicator, and news conditions. You can trigger automatic orders when conditions are met, or route a notification to your phone for review. You can even add a portfolio rule, like never allocate more than 20 percent of equity to any single symbol. Explore how it works.

Benefits and Considerations of Buy and Sell Trading

The main benefit is clarity. When your buy and sell trading rules are explicit, you reduce hesitation. You know exactly what to do and when to do it. Consistency follows from clarity. A rules based approach keeps you from overtrading during boredom or freezing during volatility. It also makes performance measurable. You can track win rate, average win and loss, profit factor, and drawdown to see whether your edge holds.

- Clarity and consistent execution

- Measurable, improvable performance

- Automation to scale across markets

Automation amplifies those benefits. Machines do not get tired or emotional, and they react in milliseconds. With Obside, you can connect rules to live orders, which helps you capture fast moves and avoid slippage from manual clicks. You also gain scalability. One person can manage dozens of symbols and complex conditions if the system does the monitoring.

There are considerations. Markets change regime. A trend strategy that performs well in a trending environment can underperform in chop. Overfitting is a risk if you optimize too many parameters on a small dataset. Test out of sample and add filters that keep you out of poor conditions, such as a higher timeframe trend filter or a volatility filter that avoids low liquidity periods.

Finally, risk management is non negotiable. Even excellent signals have losing streaks. Position sizing and predefined exits ensure that no single trade, or even a cluster of trades, can cause outsized damage. Many professionals risk a small, fixed fraction of equity per trade and scale exposure up only after evidence of robust performance.

Measuring Performance and Improving Your Rules

Once your buy and sell trading rules are live, measure them the same way a portfolio manager measures a strategy. Expectancy is a primary metric, defined as average win times probability of win minus average loss times probability of loss. Profit factor, which is gross profit divided by gross loss, tells you how much profit your winners generate relative to losers. Maximum drawdown, time to recovery, and the distribution of returns help you understand risk. You can also track Sharpe or Sortino if you seek a risk adjusted lens.

Use this feedback loop to iterate. If most losses come from false breakouts, add a filter such as a volume surge or a retest entry. If exits give back too much profit, experiment with a partial take profit followed by a wider trailing stop. If drawdowns cluster around specific news windows, add a rule to pause trading before high impact events.

Obside’s ultra fast backtesting engine makes this cycle quick. You can adjust a threshold, rerun on new data, and see whether improvements hold across multiple symbols and time periods. Test robustness by running your rules in different markets. A strategy that only works on a single ticker during one quarter is fragile.

Automation With Obside: From Idea to Execution

What makes buy and sell trading powerful on Obside is the conversational layer. You do not need to write code. You can simply tell the Obside Copilot what you want, then validate with a backtest, and deploy to live automation with connected brokers and exchanges.

- Alert me if Bitcoin rises above 150000 and daily volume doubles, then buy 1000 dollars of BTC if RSI on the 1 hour is below 70 and MACD is bullish.

- Notify me if RSI crosses 70 on EURUSD and MACD turns bearish, then sell half my EURUSD position and trail by 2 times ATR.

- Buy 50 dollars of Tesla if Elon Musk tweets about it and the stock is above its 50 day moving average, place a stop under the low of day, take profit at 10 percent.

- Keep 50 percent of the portfolio in Bitcoin, 25 percent in Ethereum and 25 percent in USDC. If volatility spikes above a threshold, rebalance daily at the close.

You can also run complex multi timeframe logic. For example: When the Supertrend becomes bullish on the 2 hour chart, if the RSI is not overbought and the Supertrend on the 8 hour chart is also bullish, then buy. For selling, use the reverse logic. Place a trailing stop loss at 5 times ATR on the 2 hour chart. Close the position if the Supertrend on the 2 hour chart changes direction.

Obside was awarded the Innovation Prize 2024 at the Paris Trading Expo and is supported by Microsoft for Startups. The platform helps pros and advanced individuals move from idea to execution in seconds, from smart alerts to automated orders and portfolio rules.

Conclusion: Next Steps for Your Buy and Sell Trading

Start simple and precise. Pick one market and one timeframe. Write down a single buy condition and a single sell condition, and define your stop, target, and position sizing. Backtest with realistic costs. Forward test on small size until execution is smooth. When you are confident, automate the alerts and orders so you can react instantly without second guessing.

If you want to accelerate that journey, open Obside Copilot, describe your rules in plain language, and validate them in seconds. From there, you can add event triggers, portfolio constraints, and risk overlays. The goal is always the same. Turn your buy and sell trading ideas into consistent, executable rules that align with your objectives and protect your capital.

FAQ: Buy and Sell Trading

What is the simplest buy and sell trading rule I can start with?

A classic is a moving average trend filter with a pullback entry. For example, only buy when price is above the 200 period moving average, then enter on a pullback confirmed by RSI recovering from oversold. Use a stop under the recent swing low and a target at 2 times risk. It is simple, testable, and teaches discipline.

Which indicators work best for buy and sell signals?

There is no universal best. Trend followers often use moving averages and MACD for direction, while mean reversion traders use RSI or Bollinger Bands for extremes. What matters is how the indicator fits your market and timeframe, and whether the full rule set produces positive expectancy after costs. Test, measure, and iterate.

How much should I risk per trade in buy and sell trading?

Many systematic traders risk a small, consistent fraction of equity per trade, often between 0.25 percent and 1 percent. The right number depends on your edge, drawdown tolerance, and frequency of trades. Smaller risk per trade typically reduces drawdown volatility and helps you stay in the game long enough for your edge to play out.

Can I combine event driven and technical buy and sell rules?

Yes, and it is often powerful. You might require a technical confirmation after a catalyst, such as buying only if price holds above the open after a positive news event. Platforms like Obside make it easy to combine both worlds in one automation.

How do I know if I am overfitting my strategy?

Warning signs include too many parameters, exceptional performance on a narrow dataset, and sharp degradation out of sample. Use walk forward testing, keep rules as simple as possible, and validate across multiple symbols and time windows. If performance holds broadly with realistic costs, you likely avoided overfitting.