Day Trading Strategies: Proven Setups and Risk Rules

Learn day trading strategies that actually hold up: clear entries and exits, risk management rules, backtesting methods, and automation to trade consistently.

If you are searching for day trading strategies, you are likely facing the same problem as many active traders. You want a clear, repeatable plan that tells you when to enter, where to exit, and how to manage risk in fast-moving markets. You might already know a few popular techniques, yet you still need to figure out what makes a strategy good, how to test it, and how to automate it so your decisions are consistent. This guide gives you that structure. It explains core principles behind good day trading strategies, walks through proven approaches, and shows how to turn a written plan into real actions you can run and refine.

Table of contents

- What are day trading strategies and why they matter

- Core principles behind good strategies

- Strategy archetypes that still work

- Design, test, and automate

- Practical examples and playbooks

- Benefits and considerations

- Conclusion and next steps

- Frequently asked questions

What Are Day Trading Strategies and Why They Matter

A day trading strategy is a defined set of rules you apply within a single trading session to capture short-term price moves. You open and close positions on the same day. Unlike swing trading, your holding period is measured in minutes or hours, which means your edge depends on intraday liquidity, volatility, and timing. The goal is not to predict the future in a vague way. It is to create a repeatable process that extracts small but consistent edges from observable conditions, like a breakout on strong volume or a mean reversion back to VWAP after a sharp spike.

At its core, a good day trading strategy is a hypothesis about market behavior that you can test and automate. If your plan says buy pullbacks in an uptrend and take profits at the prior high, you should be able to measure how often that works, what the average gain and loss look like, and how risk changes across different instruments and sessions. The more quantifiable your rules are, the easier it becomes to validate them and stick to them.

If you are new to the concept of day trading, a quick primer can help set the stage. You can explore broader definitions and context in Investopedia’s overview of day trading, which outlines the practice and the risks involved.

Core Principles Behind Good Day Trading Strategies

Good day trading strategies share a few universal traits. They are simple enough to execute, specific enough to test, and robust enough to work across varying market conditions. Whether you trade stocks, futures, forex, or crypto, the same pillars matter.

First, focus on liquidity. A liquid instrument with tight spreads and deep order books reduces slippage and improves your odds of getting filled near your intended price. Slippage is the difference between the expected trade price and the actual price, and it can erode your edge dramatically in fast markets.

Second, anchor your entries to objective signals. Many day traders rely on price breakouts, pullbacks to moving averages or VWAP, momentum shifts measured by indicators like RSI or MACD, or news catalysts. VWAP helps you gauge whether price is stretched or reverting during a session. If you use RSI, consider reviewing the RSI indicator guide with practical settings and examples.

Third, control risk with predefined exits. Set a stop loss based on technical structure or volatility. Average True Range can help you size stops so they adapt to changing market conditions.

Fourth, measure expectancy. Expectancy is the average outcome of your trades given win rate and the ratio of average winner to average loser. A strategy with a 45 percent win rate can still be positive if your average winner is much larger than your average loser.

Finally, automate your decision path where you can. Alerts reduce missed signals and prevent impulsive trades. Automated orders enforce risk management. Fast backtesting tells you whether your idea has historical merit before you risk capital. If you do not have tooling in place yet, compare options in Backtesting Software: How to Pick, Use, and Trust It and see how to move from rules to execution with Trading Automation.

Day Trading Strategy Archetypes That Still Work

Momentum Breakout

A momentum breakout attempts to capture a strong move through a well-defined level. The setup often includes a consolidation near highs, rising volume, and confirmation from a momentum indicator. You enter as the breakout triggers, place a stop just below the consolidation, and target the next key level or use a trailing stop.

A practical plan might say buy the first clean break above the morning high accompanied by volume at least 150 percent of the 20-day intraday average. If RSI is rising but not yet overbought, you have added confirmation.

Pullback in Trend

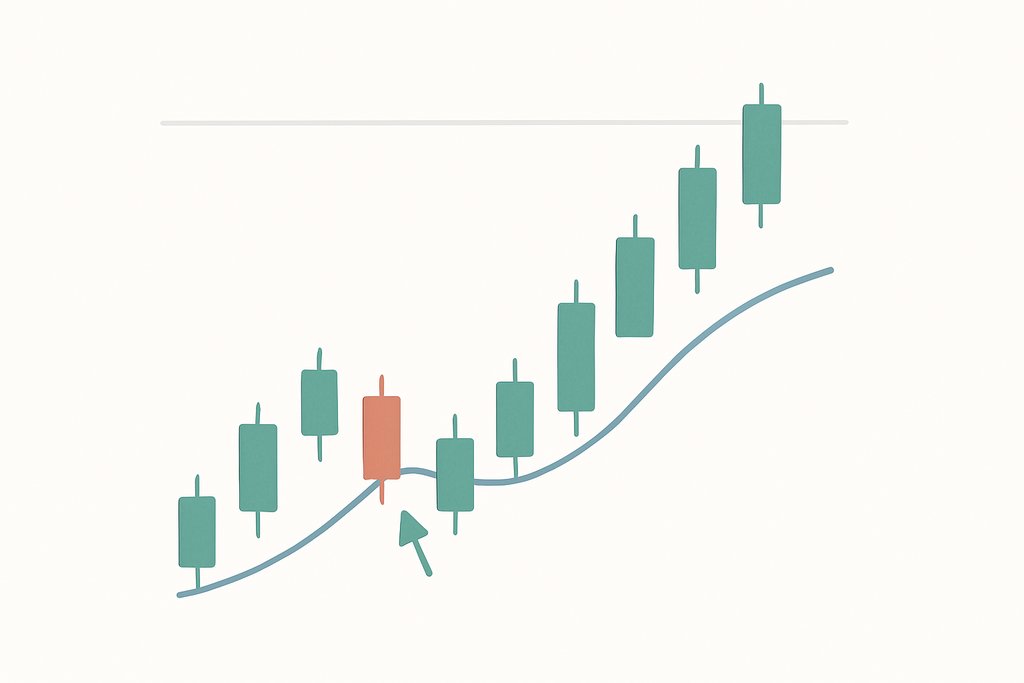

The pullback strategy waits for price to retreat to a support zone during an uptrend, often a moving average or VWAP. You enter on a reversal signal at that level, place a stop just below the swing low, then target the prior high or use a trailing stop based on ATR. This style reduces chasing and can offer favorable risk to reward when trend strength persists.

Mean Reversion to VWAP

Many intraday surges fade back toward the session’s volume-weighted average price. The idea is to fade stretched moves and exit near VWAP as the market normalizes. This can work well in range-bound sessions. It requires discipline, since mean reversion trades can struggle on trend days.

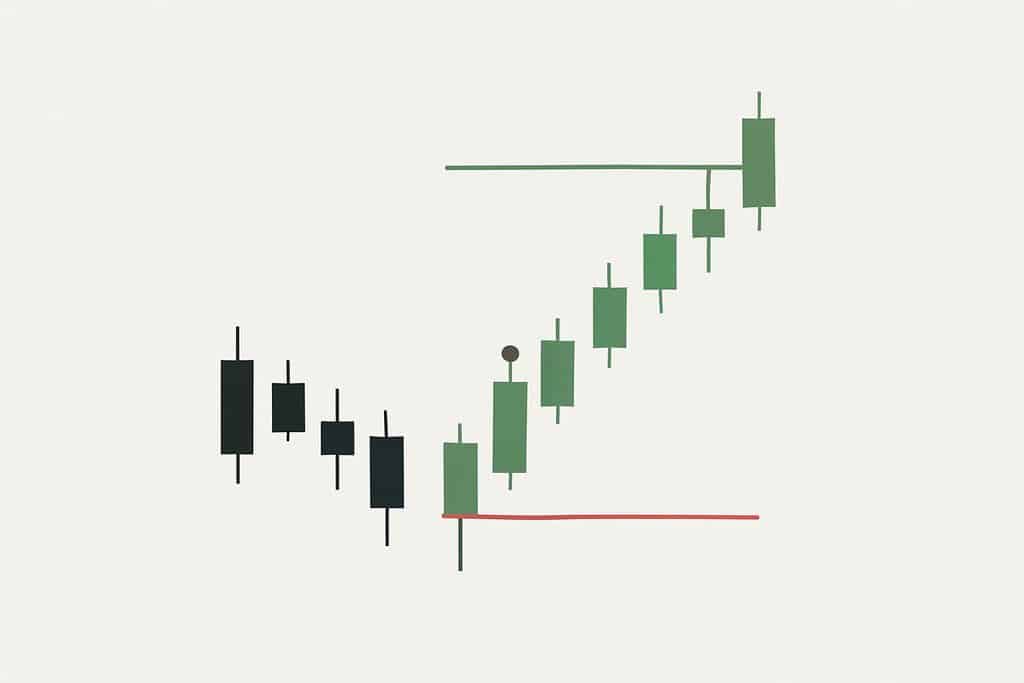

Opening Range Breakout

The opening range is the first period of the session, often the first 30 to 60 minutes. When price breaks above or below that range on rising volume, some day traders ride the move, with stops on the opposite side of the range. It is simple and tied to a transparent structure that many participants watch.

News Catalyst Scalps

A scheduled event or unexpected headline can produce short-lived dislocations. This strategy listens for alerts, then trades the initial impulse or a secondary move. Rules matter here. You need pre-defined conditions for entry, time stops to avoid lingering risk after the initial window, and strict size controls.

How to Design, Test, and Automate Day Trading Strategies

Start with a clear thesis. Decide which instruments you will trade and what market behavior you want to capture. If you believe the first hour sets the tone in large cap stocks, then define signals tied to opening range, VWAP, and volume. Write rules that remove ambiguity. Entries should be precise. Stops and targets should be set in advance. Position size should be calculated based on your risk per trade.

Backtest before you commit. A simple historical test will tell you whether your rules produced a positive expectancy. If the average win and loss are close but slippage is high, you may need to tighten rules or switch instruments. Combine statistical checks with chart reviews. Raw numbers are essential, and visual confirmation helps you understand context and failure modes.

When you have a stable plan, automate it where possible. This is where Obside shines. Obside is a financial automation platform that turns plain language descriptions into real market actions. You can describe your day trading strategy to Obside Copilot, then run alerts, automatic orders, and full rules on connected brokers and exchanges. The platform reacts to prices, indicators, news, and macro data in real time, and it includes ultra-fast backtesting so you can validate ideas in seconds.

Buy when there is a bullish divergence on RSI on a 15 minutes chart, set a stop loss on the low of the day and a take profit at 10 percent. Close the position if the Supertrend on the 2 hours chart changes direction.

When the Supertrend becomes bullish on the 2 hours chart, if RSI is not overbought and the Supertrend on the 8 hours chart is also bullish, then buy. Place a trailing stop loss at 5 ATR on the 2 hours chart. Exit if Supertrend on 2 hours changes direction.

Turn a rule into execution: set an alert for “RSI crosses 70 on EUR/USD and MACD turns bearish,” and attach an action to place a protective stop and reduce size automatically if conditions flip. Learn more in the Trading Automation guide.

Practical Examples and Playbooks You Can Use Today

A simple momentum breakout on EUR/USD might start with a morning range. Define the opening range as the first 30 minutes. If price closes above the high of that range with 1.5 times average volume, enter long. Place a stop one ATR below the breakout bar. Set a first target at two times risk and a second target near a prior session high. If MACD turns bearish before targets, tighten stops. For indicator basics and settings, see our RSI indicator reference and broader technical analysis guide.

A pullback in trend for large cap equities could use VWAP. If price is in an uptrend by simple definition higher highs and higher lows, then wait for a pullback to VWAP. Enter when a reversal candle prints at VWAP and RSI crosses above 50. Stop is set just below the swing low. Take profit at the prior high or use a trailing stop equal to 1 ATR. If the stock loses VWAP with rising volume, skip the entry.

A mean reversion plan in crypto could be designed around RSI extremes. On a 5 minute chart, when RSI crosses above 80 and price is 2 percent above VWAP, fade the move with a small size and a tight stop. Exit near VWAP or when RSI falls back below 60. Size conservatively because momentum can persist during strong trend days.

You can turn all of these plans into Obside alerts and actions. For example, create an alert that says “Notify me if RSI crosses 70 on EUR/USD and MACD turns bearish.” Couple that alert with an automated rule, such as “Sell if MACD turns bearish and price breaks below the opening range low with volume spike.” If you prefer to react to news, you can set alerts like “Alert me if Apple announces a new product” or “Tell me when OpenAI announces a new AI model,” then link actions like “Buy 50 dollars of Tesla if Elon Musk tweets about it.” With Obside, news and macro data can be triggers, just like price and indicators.

Benefits and Considerations When Building Day Trading Strategies

The benefits of a defined day trading strategy are clear. You get a consistent framework that reduces impulsive decisions. You can measure performance and improve your rules. You can automate parts of your workflow to reduce missed signals and enforce risk limits, especially when the market is noisy and fast.

- Consistent, rule-based decision process

- Measurable edge with clear metrics

- Automation for alerts, orders, and risk

- Fewer missed signals and fewer impulsive trades

The considerations are equally important. Day trading can be psychologically taxing. Frequent decisions and rapid feedback loops can lead to overtrading. Slippage and fees can turn a borderline positive plan into a negative one. Strategy drift happens when traders abandon rules after a few losses. To prevent this, set risk limits per trade and per day, use time stops to avoid lingering in weak trades, and journal your outcomes to spot patterns.

Use expectancy math to decide whether a strategy makes sense. If your win rate is 40 percent and your average winner is twice your average loser, your expectancy is positive. If your win rate dips and slippage rises, revise your entries or size, or avoid low-quality sessions. To understand probability of capital depletion, study risk of ruin.

Conclusion: Turn Your Day Trading Strategy Into Execution

Good day trading strategies are built on simple, testable rules, objective signals, and strict risk management. Pick one strategy family that fits your instrument and personality. Write your rules in plain language. Validate them with backtests and small forward tests. Then automate alerts and orders so you execute the plan without hesitation.

If you want to move from idea to execution in seconds, try Obside Copilot. Describe your strategy in everyday language, validate it with fast backtesting, and connect it to your broker or exchange for live automation.

Frequently Asked Questions About Day Trading Strategies

What are the best indicators for day trading strategies?

The best indicators are the ones that match your strategy logic. If you trade breakouts, volume confirmation and trend filters like Supertrend or moving averages can help. If you trade mean reversion, oscillators such as RSI are useful for spotting extremes, and VWAP is a solid reference for session value. Momentum indicators like MACD can confirm direction changes. There is no single best indicator. The combination that reinforces your entry and exit rules is what matters.

How do I choose the right time frame for day trading?

Choose a time frame that fits your instrument’s liquidity and your decision speed. Many day traders use a blend, such as a 1 to 5 minute chart for entries and a 15 to 60 minute chart for context. The shorter your chart, the more noise you will face, which means stricter rules and faster stops. Test your strategy across multiple time frames to see where signals are most reliable.

How much should I risk per trade in a day trading strategy?

A common guideline is to risk a small percentage of your account per trade, often 0.5 to 1 percent. Size positions so your stop loss reflects this risk. For example, if your account is 10,000 dollars and you risk 1 percent, your maximum loss per trade is 100 dollars. Use ATR or recent swing levels to place stops logically, then calculate size so the distance to your stop aligns with your risk limit.

How do I know if my day trading strategy is working?

Track key metrics. Win rate, average winner, average loser, expectancy, and drawdown tell you whether the plan is viable. Review your trades by session and instrument, since some conditions are better than others. Backtesting provides the first signal, forward testing with small size provides the confirmation. If outcomes degrade, revisit your rules, reduce risk, and consider whether market regime has changed.

Can I trade day trading strategies based on news without coding?

Yes. With platforms like Obside, you can set alerts tied to news events and trigger actions automatically, all through plain language descriptions. You can say “Sell all my positions if the S&P 500 drops by 10 percent” or “Buy 1,000 dollars of Bitcoin if the price is below 100,000 dollars.” Combining news triggers with technical filters can improve your signal quality.