W Pattern Trading: Complete, Practical Double Bottom Guide

Learn how to identify, validate, and trade the W pattern double bottom with precise entries, stops, targets, and a repeatable process you can automate.

Table of contents

- What is W pattern trading

- How to identify a valid W pattern

- Entry, stop, and targets

- Confirmations and filters

- Practical examples

- Backtesting and automation with Obside

- Benefits and considerations

- Common mistakes to avoid

- Step-by-step playbook

- Conclusion

- FAQ

- Related articles

What Is W Pattern Trading?

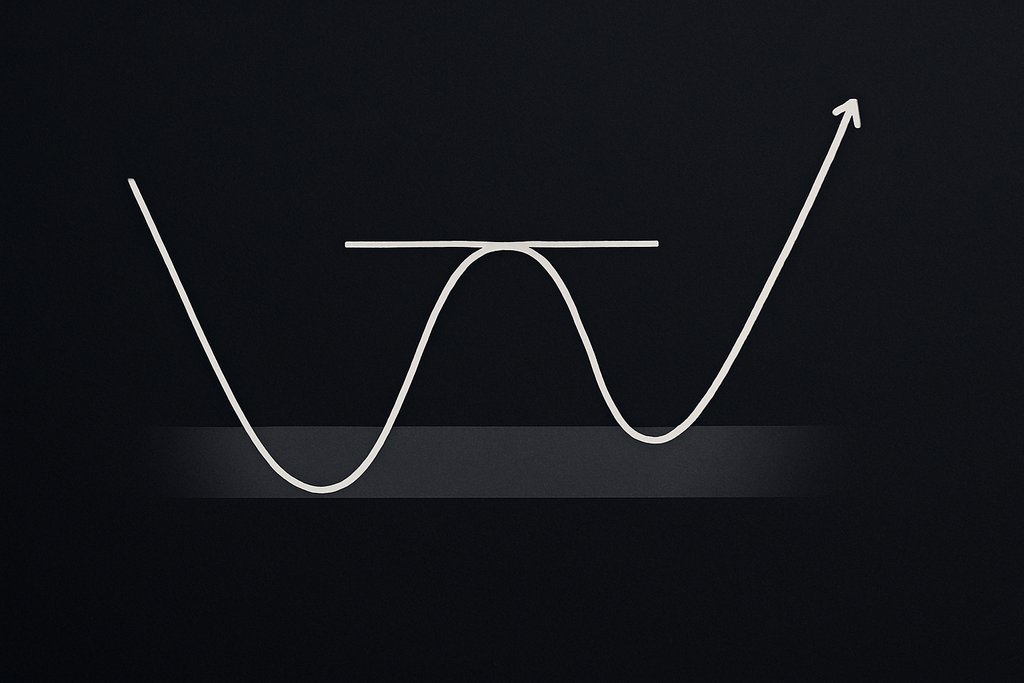

W pattern trading refers to trading the classic double bottom reversal, a two-trough formation that looks like the letter W after a prior downtrend. The pattern captures a shift in control from sellers to buyers. Price makes a first low, rebounds to a swing high, returns to roughly the same low area, then breaks above the intermediate swing high. That break is the confirmation of demand overwhelming supply.

At a high level, here is the psychology behind the W pattern:

- Sellers push price to a fresh low but buyers step in and spark a bounce.

- On the next decline, bears fail to push meaningfully below the first low, signaling diminishing selling pressure.

- A break above the mid-point high, often called the neckline, validates the reversal and opens the way for a measured move higher.

For foundational definitions and variations, see the Investopedia article on the double bottom and Wikipedia’s overview of double bottom patterns:

Double bottom on Investopedia and

Double top and double bottom on Wikipedia.

How to Identify a Valid W Pattern on Any Chart

Successful W pattern trading starts with selectivity. Not every two-lows sequence is a tradable W. You want context, proportion, and confirmation.

Start with a visible downtrend. The double bottom is a reversal pattern, so it carries the most edge when it forms after a clear series of lower highs and lower lows. If the market is already range-bound or trending up, the W becomes far less meaningful.

Focus on symmetry and proximity of the two bottoms. The second bottom does not have to match the first low exactly. A tolerance of 1 to 4 percent on liquid large-cap stocks, and slightly wider on volatile assets like crypto or small caps, is common. What matters is that the second trough shows buying interest re-emerging near the first low.

Mark the neckline. The swing high that sits between the two lows is your neckline. This is your confirmation level. A daily close above the neckline is the confirmation most traders look for. On intraday frames, a candle close rather than a quick spike generally filters out noise.

Watch volume dynamics. Volume often contracts on the second trough, which is a sign that sellers are exhausted. Then it tends to expand on the neckline breakout. You do not need a textbook-perfect volume pattern, but a pickup when price clears the neckline adds conviction.

Note small variations. Some W patterns look like a sharp V plus a rounder U, sometimes called Adam and Eve bottoms. These are valid as long as the overall structure and confirmation break hold. For a deep catalog of tendencies across variations, Thomas Bulkowski’s site is useful:

Double bottom research by Bulkowski.

Entry, Stop, and Targets for W Pattern Trading

The power of the W pattern lies in its clarity. You can translate the shape into concrete trade parameters.

Confirmation entry at the neckline. The classic entry is a buy when price closes above the neckline. Many traders require the breakout candle to close above the neckline rather than simply touch it, to avoid false signals. You can refine further by requiring above-average volume on the breakout.

Retest entry after breakout. Breakouts often retest the neckline from above. If price pulls back, holds the former resistance as support, and prints a bullish reversal candle, you can enter with a tighter stop. This can improve reward to risk but carries the risk of missing the trade if no retest occurs.

Stop placement under the second low. The typical protective stop sits a bit below the second bottom. The exact buffer depends on timeframe and volatility. ATR-based buffers, such as 1.0 to 1.5 ATR under the low on your trading timeframe, adapt to market conditions.

Measured target using the pattern height. Measure the distance from the lowest low to the neckline. Project that distance upward from the breakout point to set a first target. Many traders take partial profits at the measured move and trail the remainder under higher lows or a moving average.

Risk to reward. Prioritize setups that offer at least 2R potential. In sideways markets, widen your filters or sit out marginal patterns to avoid spending risk budget on low-edge signals.

Confirmations and Filters That Improve W Pattern Trading

A W breakout is strongest when the market is ready to trend and your filters confirm the shift in momentum. While you can trade the raw pattern, adding a few objective checks can materially improve outcomes.

Momentum divergences. Look for a bullish divergence on RSI or MACD on the second bottom. If price makes a marginal lower low but RSI makes a higher low, selling pressure is waning. Many traders require RSI to reclaim the 50 line after breakout to confirm positive momentum. Learn more in our guide to the RSI indicator and strategy.

Moving average context. Some traders filter W patterns to those where price is breaking back above a key moving average, for example the 50-period or 200-period MA. This aligns the pattern with a broader regime shift rather than a short-lived bounce.

Higher timeframe confluence. A W on a 1-hour chart that forms near a higher timeframe support zone on the daily chart carries more significance.

Volume confirmation. Breakout volume above a 20-period average can filter out weak moves. In quiet markets, relative volume above 1.2 can work as a threshold.

To systematize your rules, explore how to build, test, and automate strategies so your confirmations are applied the same way every time.

Practical Examples of W Pattern Trading Across Markets

Bitcoin on the 4-hour chart. Imagine BTC falls from 74,000 to 67,800, bounces to 70,600, then revisits 68,100. On the second bottom, 4-hour RSI prints a higher low. Price pushes back above 70,600 on expanding volume. A trader enters on the close above 70,600, stops at 67,500, and targets a measured move equal to the neckline distance. With a height of 2,800, the projected target near 73,400 offers a reward to risk near 2.2 to 1.

EUR/USD on the 1-hour. After a multi-day slide, EUR/USD prints a low at 1.0770, bounces to 1.0815, revisits 1.0775, then breaks above 1.0815 as MACD turns positive. A conservative trader waits for a retest of 1.0815, sees it hold as support, and enters on a bullish engulfing candle. Stop sits under 1.0770 by a few pips, with a measured target near 1.0860.

Tech stock on the daily chart. A stock slides into earnings, prints a first bottom at 92, bounces to 99, then retests 93 on lighter volume. After a strong report, price gaps above the 99 neckline on heavy volume. The trader enters on confirmation, stops below 92, and aims for a measured target around 106, with a trailing plan if the broader market turns up.

“Alert when a double bottom completes on the 1-hour BTC/USD with RSI above 50 and breakout volume at least 1.5x the 20-period average. Buy on close, stop 1 ATR below the second bottom, target the measured move.”

Backtesting and Automating W Pattern Trading With Obside

One of the biggest challenges with chart patterns is consistent, timely execution. You see the setup in hindsight, then miss the live breakout or cut winners too quickly. This is where Obside helps. Obside turns your plain-language ideas into market actions: alerts, automatic orders, and full portfolio rules with connected brokers and exchanges.

You can ask Obside Copilot to enforce your W pattern trading rules, then let the system scan markets, alert you, and even execute trades automatically when conditions are met. Because Obside backtests ultra fast, you can validate rules on years of data in seconds, then go live when you are satisfied. Learn more about trading automation from idea to execution.

- Alert when a double bottom completes on the 1-hour BTC/USD with RSI above 50 and breakout volume at least 1.5x the 20-period average. Buy on close, stop 1 ATR below the second bottom, and target the measured move. If the neckline retests and holds, add 25 percent.

- Scan all S&P 500 stocks daily and notify if a W forms with a 3 to 6 week span between lows, and the breakout closes above the 50-day MA. Enter next open, stop under the second low, take partial profits at 1.5R, then trail under the 20-day EMA.

Because Obside reacts to prices, indicators, news, and macro data, you can blend pattern-based entries with event-driven exits. For safe practice before risking capital, consider paper trading your W strategy and then deploying with automation.

Benefits and Considerations of W Pattern Trading

The W pattern offers several clear benefits and a few caveats to keep in mind when you execute in real time.

- Clear structure for entries, stops, and targets

- Appears across assets and timeframes

- Easy to systematize and backtest

There are important considerations. The W can fail if you anticipate the breakout and enter before confirmation. Many false starts occur when price oscillates between the two lows and the neckline in a choppy range. To mitigate this, insist on a close above the neckline and consider adding a volume or momentum filter.

Finally, no pattern guarantees a reversal. Sometimes the double bottom becomes a triple bottom or fails entirely. Manage risk aggressively, avoid martingale behavior, and accept that small losses are the cost of maintaining edge.

Common Mistakes to Avoid

A few pitfalls appear repeatedly among traders learning W pattern trading. One is forcing the pattern in a sideways market. If there is no prior downtrend, the W is less reliable. Another is ignoring the neckline close. Intrabar spikes above the neckline often reverse quickly, so waiting for a close can reduce whipsaw.

A third mistake is setting the stop too tight under the second bottom. Normal noise can take you out before the move develops. Using an ATR buffer or placing the stop under a clear swing structure helps. Lastly, be mindful of scaling in too aggressively on retests. A partial add is fine, but size should remain within your risk plan.

A Step-by-Step W Pattern Trading Playbook

Scan markets in a downtrend and shortlist candidates that show two similar lows separated by a meaningful bounce. Mark the neckline on your timeframe, then wait for a decisive close above it. If your plan includes filters, check momentum, volume, and moving average context. Set your stop below the second bottom with a volatility buffer, size the position so the dollar risk per trade matches your plan, and place initial and trailing targets based on the measured move and trend strength. If a retest occurs and holds, consider a small add within your risk limits. If the breakout fails quickly and closes back below the neckline, respect your stop or exit rules without hesitation. Consistency in these steps matters more than any single trade outcome.

Conclusion: From Pattern to Process

W pattern trading works best when you treat it as a process. Define what a valid double bottom looks like, commit to confirmation rules, and anchor your trade with a protective stop and a measured target. Resist the urge to anticipate and focus on execution quality. Then scale your edge by systematizing.

If you want to move from idea to execution quickly, try building and testing your W pattern rules with Obside. Describe your conditions in plain language, validate with instant backtests, then automate alerts and orders so you never miss a breakout.

Prefer to explore first and see how strategies and automation work together on Obside?

FAQ: W Pattern Trading

Is W pattern trading the same as trading a double bottom?

Yes. The W pattern is the visual name for the classic double bottom. You identify two similar lows separated by a swing high, then trade the breakout above that swing high, called the neckline. Many resources use the terms interchangeably.

What timeframes work best for W patterns?

The pattern appears on all timeframes. Reliability often improves as you move higher in timeframe, because noise decreases and volume confirmation matters more. Daily and 4-hour charts are common for swing traders, while intraday traders use 15-minute to 1-hour charts. Your stop size and position sizing should scale with volatility.

Do I need volume to confirm a W breakout?

Rising volume on the neckline break adds conviction, but some markets like spot forex do not offer centralized volume data. In such cases, use alternative confirmations like momentum indicators, range expansion, or market structure context. In equities and crypto, a volume surge on breakout is a useful filter.

How often does the W pattern hit its measured target?

Results vary by market, timeframe, and filters. Studies like those compiled by Thomas Bulkowski indicate that double bottoms can be among the more reliable reversal patterns, but no single statistic applies universally. The best approach is to backtest your exact rules, then monitor live performance.

Where should I place my stop in W pattern trading?

A common approach is a few ticks or a volatility buffer under the second bottom. Many traders use an ATR-based buffer to avoid being shaken out by normal noise. If you enter on a retest rather than the breakout close, you can often place a tighter stop, with a higher chance of a quick stop-out.

Does the W pattern work in crypto and highly volatile assets?

Yes, the structure appears across assets. You will need wider tolerance for the second bottom match and larger buffers for stops and targets due to volatility. Apply consistent rules and consider confirming with momentum or higher timeframe context to reduce false signals.